Community Foundations in Montana

Community foundations are organizations that can help manage community-wide discussions and collect and distribute funds for local development. Learn how community foundations can engage citizens in distributing grants, participating on boards, contributing to community planning, and securing assets.

Last Updated: 02/18by Paul Lachapelle, Community Development Specialist; and MSU Extension Agents: Jennifer Anderson, Rosebud-Treasure Counties; Jesse Fulbright, Liberty County; Abbie Phillip, Deer Lodge County; Mandie Reed, Wheatland County; Lisa Terry, Stillwater County

What is a Community Foundation?

Community foundations are non-profit, public charities that manage funds for individuals, families, corporations, and non-profit organizations that grant money back to a community or region. These funds are often endowed; this means the principal amount remains intact while income from investments are provided in some charitable effort of the donor's choice. Differing from private foundations that are often focused on a specific topic or area of interest, community foundations are often focused on a specific geographic area. Community foundations are typically run by a volunteer board of directors from the community, who serve to provide collective oversight of the funds and grant-making objectives. Donors can decide if they want to make a charitable contribution in the present or as a future gift and advise how donations will be spent. Community foundations can also offer tax savings, including the Montana Charitable Endowment Tax Credit.

Community foundations encourage members of a specific community (defined by a geographic area but sometimes as a community of interest or identity) or region to engage in conversations about the present and future vision of the community. This can include discussion about current and future leadership capacities, how to strengthen relationships, build trust, and work to identify, prioritize and address the needs and aspirations of the community.

Community Foundations in Montana

The state of Montana has more than 70 community foundations, many of which are affiliated with the Montana Community Foundation (MCF) that manage the community funds. The MCF serves a role for those foundations that are small or that have not filed for non-profit, tax-exempt status, since the community funds can be leveraged with other funds to create a larger investment pool.

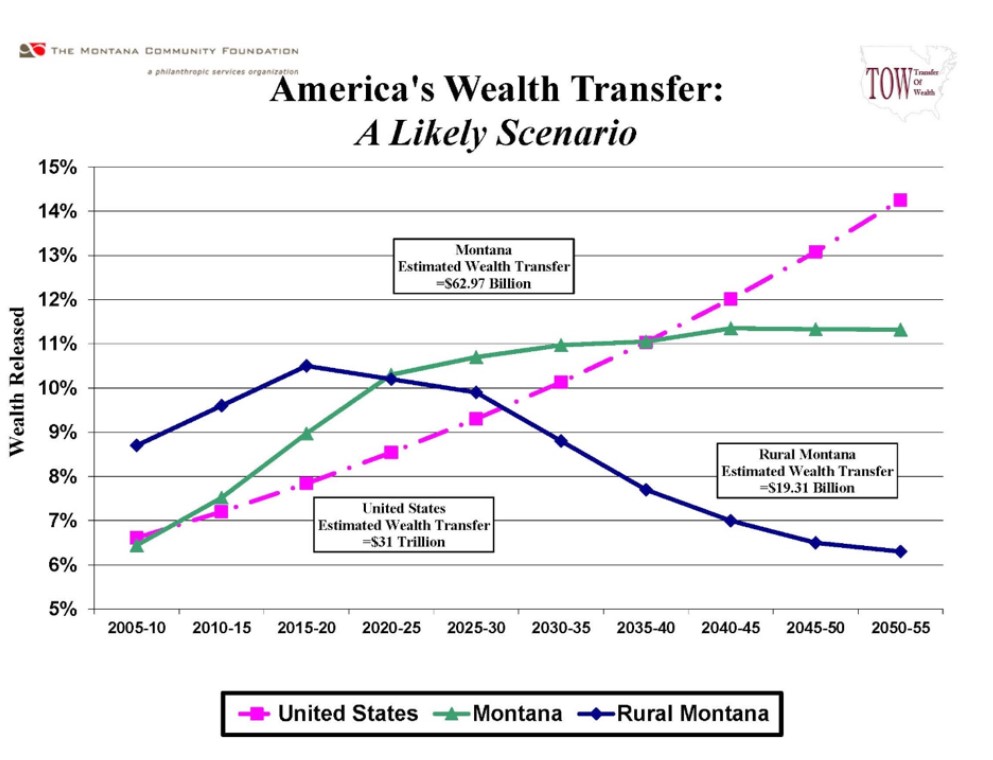

It is estimated by Macke, Markley, & Binerer (2012), that between 2010 and 2060, approximately $123 billion of wealth will be transferred in Montana; if just 5 percent, or $6 billion, of this wealth transfer was captured in permanently-endowed funds, a potential $307 million could be available annually through foundations for grants to support community development. With a rapidly aging population in Montana, the potential for donations and bequests to foundations is sizeable, as is the subsequent economic development and benefit of capturing this transfer of wealth. Figure 1 compares the projected transfer for wealth in Montana, its rural areas, and the United States.

The first community foundation was created in the city of Cleveland in 1914. According to the Council on Foundations, there are now over 750 community foundations in the United States that serve an estimated 81 percent of the population. These foundations have approximately $50 billion in permanently-endowed funds and provide almost $4 billion in grants to communities each year.

FIGURE 1. Projected transfer for wealth in Montana, its rural areas and the United States.

What can Foundations do in Your Community?

Foundations have the potential to provide many opportunities for community members to work together to accomplish common goals. Research from National Task Force on Community Leadership (2008), as well as additional resources from the Council on Foundations (see References and Resources below) has shown that some of the benefits of community foundations include:

- Fundraising and Asset Development - Community foundations are responsible for securing and investing private and public donations in an effort to build endowments. Securing donations can take many forms and can include fundraising activities such as community dinners, annual donor campaigns, silent auctions, and other events that increase the foundation’s endowment or offset operating expenditures. In comparison, asset development often comes in the form of planned gifts such as bequests, charitable gift annuities, real estate, commodities, or other capital such as livestock. A foundation can work to identify and engage local, regional, and national funding partners to accomplish both fundraising and asset development goals. The board can also work with professional partners such as estate attorneys, public accountants, and wealth advisors who use transfer of wealth information to partner with philanthropic community members and build an endowment. Other methods of increasing capital include educating the public about philanthropy, soliciting gifts from local donors, and soliciting capital from outside the community. In addition to managing their own funds, community foundations can also manage transactions for donors and connect local philanthropists with one another.

- Strategic Grant-making - Grant-making is the process of awarding funds to organizations that undertake charitable activities. The foundation can fund many different projects since the mission and scope are often not limited or restricted to one specific area of giving. Boards may work with volunteers to review grant proposals and determine priorities and funding allocations. Foundations can also play a role in creating connections between givers and recipients.

- Managing the Foundation as a Nonprofit Organization - Community foundations can also serve as a fiscal sponsor to other organizations or projects that do not have tax exempt status in the community. Fiscal sponsorship is a formal arrangement that allows the organization to seek grants and solicit tax-deductible donations under the community foundation’s exempt status.

- Engaging the Community - Community foundations can engage citizens collectively in focused dialogue about securing, investing and appropriating endowed funds. To do this, foundations can use a variety of processes such as listening sessions, study circles, needs assessments and community visioning. Community visioning is a citizen-based planning process in which sectors of a community collectively determine a project and coordinate a plan of action. Consequently, the relationship between a community visioning process and a community foundation’s overall goals is both a prerequisite and expected outcome. In this sense, community foundations can be seen as catalysts to engage citizens in a coordinated process of designing and implementing a shared community vision.

- Education and Networking - Community foundations can serve to educate the community about philanthropy in general and the specific goals and objectives of the foundation. Foundations can also track data about community well-being, compile information about local organizations, research community issues, and distribute information. Community foundations are also able to evaluate and measure the outcomes and impacts of their own programs and the programs of other organizations. The foundation can educate donors about community issues, and provide networking opportunities such as initiating community planning activities, implementing collaborative actions, and monitoring and evaluating short- and long-term impacts of projects.

- Leadership and Team-building - Community foundations can establish, develop, and expand on the leadership potential of a community. Building community capacity can take various forms including promoting non-profit organizational effectiveness, developing the skills of local residents, growing local entrepreneurs and businesses, and providing direct support to local government. The leadership role that foundations serve can also include facilitating volunteerism, promoting community dialogue, strengthening social connections among residents, empowering resident decision-making, and building collaborations between people and organizations.

Board Governance

Board members should be reflective of the diversity and interests within the community they serve. Ideally, a community foundation would recruit members with a variety of professional skills and affiliations such as accounting, investing, non-profit management, fundraising, leadership, legal expertise, networking, marketing, and communications. Board members should engage in equitable and inclusive activities and be reflective of the demographic they want to serve. Board members can choose to operate the foundation as either an independent foundation or as an affiliate of another foundation. When board members representing the foundation allow the community to develop projects that are chosen and implemented by community members, local residents have direct control to leave a lasting legacy for future generations.

An effective community foundation board identifies its governing practices through bylaws outlining specific policies and procedures. The board’s bylaws should define the organization’s purpose, location, and board member powers and duties. A foundation board must have the power to modify any restrictions or conditions on the distribution of funds, replace any trustee, custodian or agent for breach of fiduciary duty, and treat all funds as assets of the organization. The board must also be able to prepare legal and financial reports for proper submittal. There are materials that board members should be familiar with and able to access. For example, the following educational and overview materials may be helpful, particularly for new board members: board and staff position descriptions, marketing materials (printed and online), board member biographies (past and present), community assessments, timeline of future meetings/events, and a glossary of financial and legal terms. The following reports, statements and documents will also be helpful: Articles of Incorporation and Bylaws, annual reports, mission/vision/values statements, past board meeting minutes, IRS Form 990, financial statements, grant recipients and descriptions, and donor mailing lists. The following policies may also be helpful: conflict of interest, confidentiality, ethics or whistleblower, investment, liability (and Directors and Officers liability Insurance details), and gift acceptance. Board members may also choose to adopt job descriptions for volunteers. Specific job descriptions are beneficial if the organization opts to hire paid staff members.

Summary

Community foundations focus on developing ways of building community capacity and addressing a range of social, economic and environmental needs. Community foundations meet critical needs in communities and will continue to serve as opportunities for community and economic development. These organizations can serve to transform a community in collecting and distributing funds to address community development needs, as well as connecting and engaging citizens in critical conversation about localized present and future needs.

Glossary

These terms were collected from various existing resources on community foundations including the Council on Foundations, the Montana Nonprofit Association and The Foundation Center.

501(c)(3): Section of the Internal Revenue Code that designates an organization as charitable and tax-exempt.

Articles of Incorporation: A document filed with the secretary of state or other appropriate state office by persons establishing a corporation. This is the first legal step in forming a non-profit corporation.

Assets: Cash, stocks, bonds, real estate, or other holdings of a foundation. Generally, assets are invested and the investment income is used to make grants.

Bylaws: Rules, policies and procedures governing the operation of a non-profit corporation. Bylaws often provide the methods for the selection of directors, the creation of committees, and the conduct of meetings.

Challenge grant: A grant that is made on the condition that other monies must be secured, either on a matching basis or via some other formula, usually within a specified period of time with the objective of stimulating giving from other sources.

Charitable gift annuities: A gift instrument that provides payments during a donor's lifetime in return for a charitable gift, which, after the donor's death, is used for the ongoing support of the community or other non-profit purposes designated by the donor. Payments can begin immediately or can be deferred for a period determined by the donor and set forth in an annuity contract.

Designated funds: A type of restricted fund in which the fund beneficiaries are specified by the grantors.

Donor-advised fund: A fund may be classified as donor-advised if it has at least three characteristics: (1) a donor or person appointed or designated by the donor has, or reasonably expects to have, advisory privileges with respect to the fund’s distributions or investments, (2) the fund is separately identified by reference to contributions of the donor(s), and (3) the fund is owned and controlled by a sponsoring organization, such as a community foundation.

Donor intent: The desires, intentions, or expectations of an individual or group making a contribution to the foundation or other grant-making organization. Donor intent can be legally binding for those administering the contribution, such as grant makers.

Endowment/Endowed funds: The principal amount of gifts and bequests that are accepted, subject to a requirement that the principal be maintained intact and invested to create a source of income for a foundation. Donors may require that the principal remain intact in perpetuity for a defined period of time or until sufficient assets have been accumulated to achieve a designated purpose.

Form 990: An IRS form filed annually by public charities or private foundations. The IRS uses this form to assess compliance with the Internal Revenue Code. The forms list organization assets, receipts, expenditures, compensation of officers, and grants made during the year.

Impact investing: Investments made, often at the local level, with the intention of generating a measurable, beneficial social or environmental impact alongside or in lieu of a financial return.

Matching grants: Funds that are granted on the condition that funds from other donors are committed before the grant is released.

Montana Charitable Endowment Tax Credit: The Charitable Endowment Tax Credit was originally enacted in Montana in 1997 and renewed in 2001, 2007, and 2013. The law provides for a credit for planned and outright gifts. Through this tax credit incentive, a Montana taxpayer receives a reduction on their taxes by making a qualified charitable contribution to a qualified endowment. A taxpayer is allowed a tax credit in an amount equal to 40% of the present value of the aggregate amount of the charitable gift portion of a planned gift made by the taxpayer during the year to any qualified endowment. The maximum credit that may be claimed by a taxpayer for contributions made from all sources in a year is $10,000 per individual or $20,000 per couple. The credit may not exceed the taxpayer’s income tax liability. The law is set to expire on December 31, 2019. To find details on this tax credit, visit http://www.mtnonprofit.org/EndowFAQ/

Planned gifts: A planned gift (also termed legacy gift) is a contribution that is arranged in the present and allocated at a future date. Commonly donated through a will, trust, or charitable annuity, planned gifts are often granted once the donor has passed away or the principle has been relinquished.

Restricted funds: Assets or income that is restricted in its use, in the types of organizations that may receive grants from it, or in the procedures used to make grants from such funds.

Social investing: Also referred to as ethical investing and socially-responsible investing, is the practice of aligning a foundation's investment policies with its mission. This may include making program-related investments and refraining from investing in corporations with products or policies inconsistent with the foundation's values.

Strategic grant-making: A broad term for a foundation that directs grants to address specific community needs with a defined impact. A strategic foundation may engage in many approaches as long as these approaches work toward creating a planned result. The community foundation's board shapes the grant-making program around the needs of the community and changes the board hopes to accomplish, rather than making grants randomly.

Unrestricted Funds: Those that are not specifically designated to particular uses by the donor, or for which restrictions have expired or been removed.

References and Resources

Council on Foundations www.cof.org

Foundation Center www.foundationcenter.org

Kasper, G., Marcoux, J. & Ausinheiler, J. (2014). What’s Next for Community Philanthropy: Making the Case for Change.San Francisco: Monitor Institute. Available at: www.monitorinstitute.com/communityphilanthropy

Macke, D., Markley, D., & Binerer, A. (2012). Transfer of Wealth in Rural America - Understanding the Potential, Realizing the Opportunity and Creating Wealth for the Future. Lincoln, NE: Center for Rural Entrepreneurship.

Montana Community Foundation www.mtcf.org

Montana Community Foundation (2012). MontanaTransfer of Wealth Update Technical Findings Report for the Montana Community Foundation, Lincoln, NE: Center for Rural Entrepreneurship. Available at: www.energizingentrepreneurs.org

Montana Nonprofit Association, Charitable Endowment Tax Credit www.mtnonprofit.org/AboutTaxCredit

National Standards for U.S. Community Foundations www.cfstandards.org/faq

National Task Force on Community Leadership. (2008) Framework for Community Leadership by a Community Foundation. Arlington, VA: Council on Foundations. Available at: www.cfleads.org/community-engagement/CFLeads-Framework.pdf

Acknowledgement:

This MontGuide has been reviewed by members of the following organizations and their assistance is gratefully acknowledged: Montana Community Foundation, Bozeman Area Community Foundation, Missoula Community Foundation, and the Montana State University Department of Agricultural Economics and Economics.