Beef Cattle Share Leases

This MontGuide is a modified and updated version of Montana State University Extension Bulletin 120, Pasture Leases and Beef Cattle Share Arrangements, by Kent Williams, John Lacey, Dave Phillips, and John Ranney

Last Updated: 07/21by by Kate Binzen Fuller, Assistant Professor/Extension Specialist, Dept. of Agricultural Economics and Economics; and Rachel Endecott, former MSU Extension Beef Cattle Specialist

Introduction

Agricultural leases can be fixed or flexible, paid in cash or based on production – for example, proceeds from crop or calf sales. Leases can be for land only, but can also include buildings, improvements, livestock, and machinery. In this bulletin, we discuss general cattle share leases and guidelines for developing effective lease arrangements. In these arrangements, a livestock owner compensates a livestock operator for managing part or all of their herd. Many different types of livestock sharing arrangements exist – even among cow/calf operators alone. This guide is written for beef cattle producers, but the concepts could be adapted and applied to any livestock share arrangement.

Advantages

Cattle sharing allows the cattle owner and operator to share in the risks – and the profits – of the operation. Leasing cattle can be a useful way for new operators to start to develop a cattle herd or for existing operators to expand their operation – without taking on a large debt load, which becomes especially relevant in times of high cattle prices. For cattle owners seeking to retire or lighten their workload, leasing out their cows can be a way to remain in the business, without some of the dayto-day stresses of managing a herd. Leasing out a percentage of the cowherd can also be a way to add diversification to a farming or ranching enterprise.

Disadvantages

Cattle share arrangements are more complicated than most range or pasture leases, and may take more time to create and refine so that all interested parties mutually benefit. The livestock owner loses direct control of livestock management decisions, and may receive lower returns if the operator makes poor management decisions or is inefficient.

Factors to Consider in Developing Share Arrangements

Share arrangements should be mutually advantageous and fair to both parties. Agreement on decision-making, record-keeping, and what happens during drought, fire and other emergencies is needed. For most successful cattle share leases, the distribution of earnings will reflect the respective cost and labor contributions of both parties to the lease. Both livestock owner and operator normally assign costs to the resources they contribute to the lease. As in any negotiation, the final valuation of these contributions may be influenced by the bargaining process where final lease shares are specified.

Fixed and variable costs incurred by both the livestock owner and operator should be considered. Fixed costs are incurred regardless of management strategy. They include depreciation, interest, repairs, taxes and insurance. Variable or operating costs vary with output; in the cow/calf case, output is the calves sold. Operating costs include feed, labor, veterinary service, repairs, trucking, and marketing.

Both parties should also consider a variety of management issues. In the case of a cowherd leasing arrangement, who provides replacements? Who establishes management practices? When are calves sold? What are the feeding practices? Who provides the bulls?

A Sample Sharing Arrangement

Many different types of share arrangements are available. These can include the livestock owner paying the operator a specified share of gross receipts, a set rate per pound of gain, or a base rate that flexes according to price and/or volume. An equitable arrangement, one in which the proceeds are divided by the contributions of the parties involved, takes more work but can be more rewarding as well. In what follows, we outline an example of calculating equitable percentages for livestock sharing.

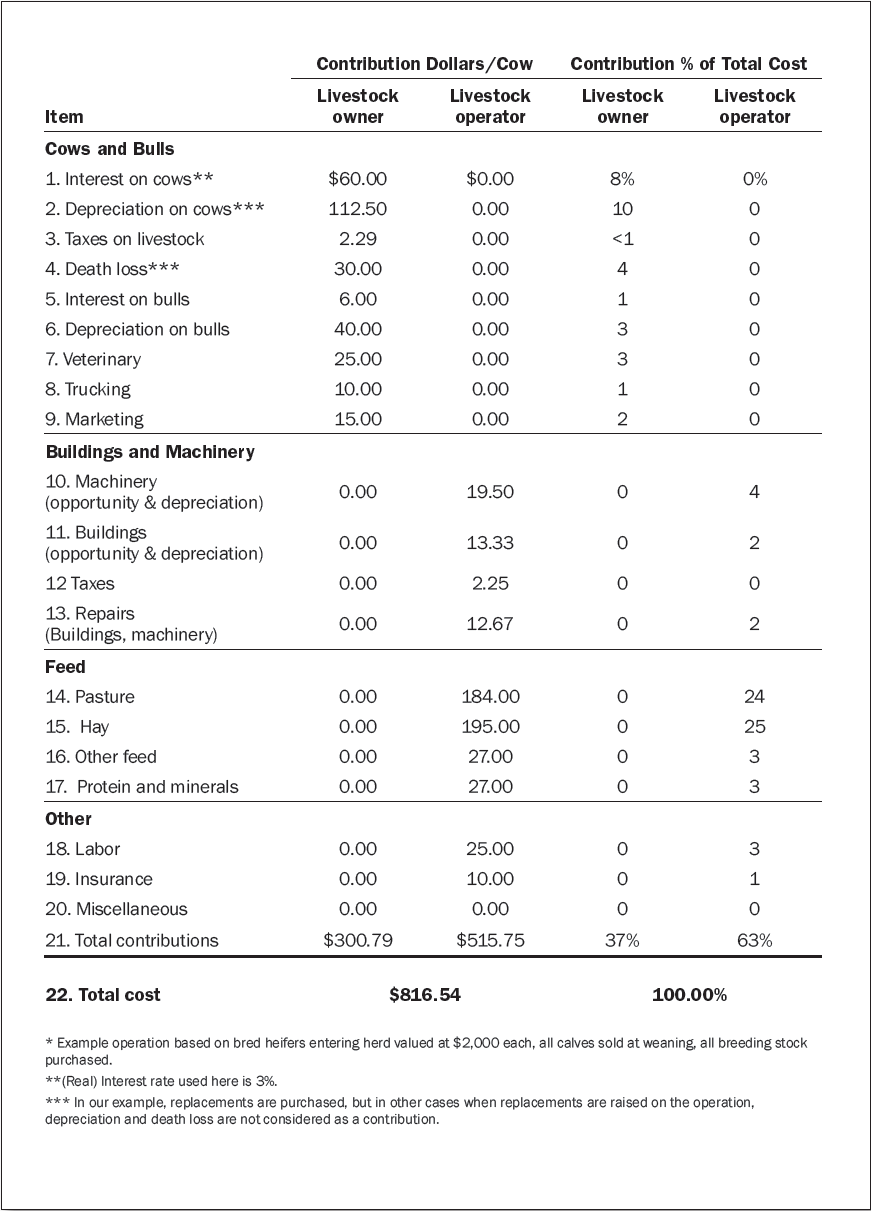

An equitable arrangement should be developed jointly by the operator and livestock owner. They must decide upon the resources to be contributed by each party, the costs attached to the resources contributed, and the percentage of costs contributed by each party. An example of a worksheet used to estimate per cow costs associated with a cattle share arrangement is demonstrated in Table 1, and the individual table entries are discussed following the table. A form such as this may be filled out jointly by the operator and livestock owner. In other cases, each party may fill out the form in its entirety, assigning costs to the resources offered by the other party as well as assigning costs to their own resource contributions. They can then negotiate the resulting calculated shares.

In this example, the lease represents a beef cattle operation with 300 mother cows, where all calves are sold at weaning and all breeding stock is purchased. All costs shown are calculated on a per cow basis. After each cost is calculated, it is entered either in the livestock owner or operator column depending on who bears the cost. Total contributions, per cow, for each party are shown on Line 21. Percentage of total costs contributed by both the livestock owner and operator are then used to calculate the percentage contributions of each party (Line 22). Future income can be divided or shared in these same percentages.

Interest on cows

An opportunity cost of using funds to purchase cows rather than making another agricultural investment is based on the market value of each cow and a real interest rate of 3%. The real rate of interest (reflecting the long-term real rate of return on agricultural investments) is calculated by subtracting the annual expected rate of inflation (over the period of the lease) from the expected nominal interest rate.

In the example, the livestock owner contributed $60 per cow per year (3% interest on a $2,000 cow, Line 1).

Depreciation on cows

Annual depreciation on cows is the way the $2,000 cost of bred heifers, paid by the livestock owner, enters our table on an annual basis. The total depreciation is the difference between the average value of a cow when it is placed in the herd and its estimated value when it is culled from the herd.

In the example, the $2,000 cow remains in the herd for eight years and is sold (as a 10-year-old) for $1,100. Therefore, the cow has a total depreciation of $900 ($2,000 - $1,100) and an annual depreciation of $112.50 ($900/8 years).

Depreciation in the example was recorded as a livestock owner's cost (Line 2). Although depreciation of cows is a cost contribution when replacement heifers are purchased, such a cost may not be included in the same way when replacement heifers are raised in the operation. In this case, either the cost of raising replacements (representing the direct cost) or the depreciation value of replacement heifers if they were sold (representing the opportunity cost of those replacements) would have been included in the operating costs instead.

Taxes on livestock

The Montana Department of Revenue collects a per capita (per head) fee on livestock. For cattle, the rate is $2.29 per head as of 2020. (For other livestock, see http://liv.mt.gov/cs/percapita.mcpx). Tax rates and methods of calculation change often, so it is a good idea to check that accurate rates are being used in these calculations.

Death Loss

Death loss should be calculated by multiplying the percentage death loss by the average value of the animal. In the example, a death loss of 1.5% resulted in a per cow loss of $30.00 ($2,000 x 0.015). Death loss was a contribution of the livestock owner (Line 4).

Interest on Bulls

The opportunity cost on bulls is calculated as previously shown for cows. However, because we are calculating in per-cow terms, the opportunity cost on investment per bull must be divided by the number of cows the bull breeds.

In the example, the interest on a $5,000 bull that breeds 25 cows is $6.00 ([$5,000 x 0.03]/25). This cost is contributed by the owner of the livestock (Line 5).

Depreciation on bulls

Depreciation on bulls is calculated similarly to depreciation on cows. However, the depreciation cost on bulls must be divided by the number of cows the bull breeds.

In the example, the bull purchased at $5,000 is used for three years and has a salvage or cull value of $2,000. While total depreciation on the bull is $3,000 ($5,000 -$2,000), annual depreciation allowance on a per cow basis is $40 ($3,000 /3 years = $1,000; $1,000/25 cows = $40). This was recorded as the livestock owner's cost (Line 6).

Veterinary Service, Trucking & Marketing

Because these costs have a direct effect on profitability, it is recommended that both parties mutually evaluate and decide on the appropriate amount of expenditure in each item.

In the example, the livestock owner's (per cow) contributions of $25.00 for veterinary medicine and services, $10.00 for trucking, and $15.00 for marketing (brand inspection, commission, checkoff, yardage, etc.) are recorded on lines 7-9.

Opportunity cost and depreciation on buildings and machinery

Opportunity cost and depreciation on buildings and machinery used in an operation are contributions of the party who owns them. The opportunity cost is the real rate of return an owner could earn on the average value of investment in buildings and machinery over the life of the lease. Opportunity cost and depreciation allowances on buildings and machinery should be divided by the number of cows on the ranch, not just by the cows in the share agreement.

In the example, the ranch does not have any cows outside of the share arrangement, so opportunity costs were calculated using the average value of machinery in the share operation. Per-cow average opportunity cost on machinery (such as pickup trucks, a trailer, a tractor, and a bale processor that totaled $100,000 when they were purchased and have a $10,000 salvage value) was $4.50 ([$100,000 - $10,000]/2 = $45,000 x 0.03 [real rate of interest]/300 cows = $4.50). Per cow depreciation allowance on machinery with 20 years of useful life was $15.00 ([$100,000–$10,000/20] /300 cows = $15.00). Thus, total opportunity and depreciation cost of machinery is $19.50. This was recorded as a livestock operator contribution (Line 10).

In this example, we depreciate buildings over 40 years, at an annual depreciation rate of 2.5%. In the example, the landowner paid $100,000 for the buildings when they were purchased 20 years ago. Because the buildings are currently worth $50,000 ($100,000 x [20-year age/40-year life]) the per-cow opportunity cost allowance is $5.00 ([$50,000 x 0.03]/300 cows). Per cow allowance for depreciation on buildings is $8.33 in this example ($100,000 [initial cost] x 2.5% [annual depreciation]/ 300 cows). Thus, total depreciation and opportunity cost allowances on buildings is $13.33. This is reported as a livestock operator contribution (Line 11).

Taxes on buildings and machinery

Tax rates change frequently, and should be checked with the Department of Revenue before making decisions based on tax rates posted in previous years. In Montana, buildings fall under class 4 personal property, which in 2020 was taxed at 1.35% of value. Buildings valued at $50,000 will incur a tax of $2.25 per cow ($50,000 x 0.0135)/ 300 cows.

Machinery falls under class 8 personal property and the first $100,000 is not taxed. (The rate on $100,001 to $6 million of class 8 personal property is 1.5%, and on $6,100,001 and up it is 3%). Because this operation does not have more than $100,000 in machinery, no taxes are collected for machinery.

Repairs

Repairs on buildings, equipment, fences, wells, etc. represent the maintenance cost incurred by the livestock operation. We assume repairs to average 4% of current value of these items, so the annual repair bill on a per cow basis for machinery and buildings is $15.67 ($45,000 [average value of machinery] + $50,000 [current value of buildings] = $95,000; $95,000 x 0.04 =$3,800; $3,800/300 cows = $12.67). This is reported as a livestock operator contribution (Line 13).

Pasture

Pasture should be valued at its opportunity cost in the rental market. In other words, it should be valued at the amount for which it could be rented to someone else. In the example, the livestock operator’s pastures contributed the total forage for 8 months. At $23 per head per month, the forage was valued at $184 ($23 x 8 months) (Line 14). Grazing lease rates can be found at aglease.msuextension.org.

Hay, supplements, and minerals

All inputs or costs incurred during the year should be valued at their purchase price delivered to the ranch. In the example, the cost per cow was $27 in protein and mineral costs, $195 in hay costs (1.5 ton at $130/ ton), and $25 in other supplement costs, for a total of $247. These costs were recorded as livestock operator contributions (Lines 15, 16 and 17).

Labor

The operator’s labor should be valued at the opportunity cost for that labor, that is, the wage or salary he or she would receive if employed in his or her best alternative in the community. Only the portion of time that is spent on the leased cattle over the term of the lease should be included. Work contributed by the operator's family and by the owner of the cattle would be evaluated similarly. In this example, the operator could make $15 per hour if he worked off-farm. Over the course of the year, he works 500 hours with the leased animals, for a total value of $7,500 (500*$15), or $25 per cow ($7,500/300) (Line 18).

Insurance

The insurance on the livestock, machinery, buildings, etc. is the actual cost paid by one or both parties. Liability insurance should also be considered. In the example, the landowner's insurance for the total operation equaled $10.00 per cow (Line 19). The insurance cost should only include the portion of the operation used by the cattle in the lease agreement.

Total Contributions

Each party's contributions toward the cow's production costs ($816.54) are totaled on line 21. They represent a 37% and 63% contribution from livestock owner and livestock operator, respectively. These percentages should be used as a guide for dividing future income and production. If future returns exceed the total production price, both parties of the lease should receive a profit on their contributions of land, labor, and capital.

However, if the future returns are less than the production price, one or both of the parties will not receive a profit. In the short run, the two parties may decide to forego a reasonable return on opportunity costs, depreciation, etc. and continue the lease agreement as long as actual expenses are covered.

Let’s say that in 2016, the 300 mother cows gave birth to 144 steer calves and 151 heifer calves. Four steer calves died during a cold spell, along with one heifer calf, so 140 steer calves and 150 heifer calves remained. The steer calves sold at an average weight of 600 pounds and the heifers at 550. The sale price for steers was $170 per hundredweight, and heifers sold for $160 per hundredweight. Total sales were $274,800 for the year (140 steer calves x 600 lbs x $1.70/lb = $142,800 and 150 heifer calves x 550 lbs x $1.60/lb=$132,000). Based on the 37- 63 split of livestock owner to operator, the livestock owner would receive $100,828 from the sales, and the livestock operator would receive $173,972. This year, both parties will turn a profit. However, this accounting process is also useful in calculating 6 breakeven prices. By varying the price of calves, we learn that if the price falls below an average of $148 per hundredweight, this operation will lose money.

This method of determining a cow share agreement is called the cost contributions, or equitable, approach. While it attempts to reflect the actual contributions of each party, the current market for share arrangements in the area should be considered (if known). If this method shows a 30-70% split in contributions and the current market for share agreements in the area is 40- 60%, then the individual parties should evaluate the factors influencing the different estimates and possibly negotiate a new rate before entering into an agreement.

Leasing agreements should be monitored to assure that the arrangement continues to be equitable. Fluctuating cattle and input prices, and changing labor conditions can cause a shift in the cost of contributions of one or both parties. To reflect current cost contributions, one or both parties may desire to renegotiate the lease.

The Written Agreement

A cattle-share arrangement, given the usual complexity in laws, is best recorded in writing. Lease components should include management practices and strategies used during the lease, who will be responsible for what aspect of production, how compensation will be exchanged, whether and what type of insurance is required, and what will happen if someone involved in the lease dies. It also must include the names of the parties, an accurate description to the property, beginning and ending dates of the arrangement, what each party is to furnish, limitations on land use and other special clauses, extent of participation in government programs, the rights and responsibilities of each party, and the respective signatures of both parties. The MSU Extension Montguide, Grazing Leases, (MT201601HR), gives additional detail on items to include when crafting a lease. Qualified legal assistance should be consulted when setting up a lease, especially for the first time.

Useful resources

- Montana State University Agricultural Land Leasing aglease.msuextension.org

- Grazing Leases (MT201606HR) Montana State University Extension (PDF)

- Beef Cow Rental Arrangements for Your Farm, Oklahoma State University Extension https://extension.okstate.edu/fact-sheets/beef-cow-rental-arrangements-for-your-farm.html

Acknowledgements

We are grateful to our reviewers for providing feedback on this document.

Disclaimer

This publication is not intended to be a substitute for legal advice. Consultation with a lawyer is advised.

WORKSHEET: Estimate of Contributions for a Beef Cattle Sharing Arrangement