Montana Common Law Marriage & Estate Planning

The purpose of this MontGuide is to explore Montana common law marriages from an estate planning perspective. Topics include: The definition of common law marriage, what establishes a common law marriage, what documentation is necessary for a common law marriage, and what amount the surviving spouse of a common law marriage inherits.

Last Updated: 11/19by Marsha A. Goetting, Ph.D., CFP®, CFCS, Professor and Family Economics Specialist, Montana State University Extension

John and Mary, an unmarried couple, lived together for 15 years prior to John’s death. They never obtained a marriage license or had a wedding. John had two children from a previous marriage while Mary had no children.

They did not have any children together. All property was in John’s name only. He died without a written will. Does the property valued at $2 million pass to John’s two children or to Mary? It depends....

Mary filed in district court as a surviving spouse because she believed she and John had a common law marriage. If Mary “wins,” she inherits $1,075,000 while John’s children from his previous marriage inherit $925,000.

Why the difference in amounts? Under Montana law the estate of a person who dies without a will is divided between his spouse and children from a prior marriage. If Mary is not a “wife,” all of John’s estate passes to his children.

John’s two children asserted in district court that a common law marriage between their dad and Mary definitely did not exist. If they “win,” they inherit their father’s estate – all $2 million. Nothing passes to Mary.

The district court must decide: did Mary and John have a common law marriage?

After the death of one party, there may be confrontations between the “surviving spouse” of a perceived common law marriage and the deceased person’s other heirs – children, grandchildren, parents and/or siblings. An estate plan could help prevent these conflicts. Also, court costs and attorney fees could be avoided from a contentious court case to determine the existence of a common law marriage.

The purpose of this MontGuide is to explore Montana common law marriages from an estate planning perspective. Topics included are:

- The definition of common law marriage;

- What establishes a common law marriage;

- What documentation is necessary for a common law marriage; and

- What amount the surviving spouse of a common law marriage inherits.

The MontGuide does NOT examine federal or state rules for common law marriages for the determination of benefits established by the Social Security Administration or the Montana Workers’ Compensation Bureau or the determination of income taxes by the Internal Revenue Service or Montana Department of Revenue.

What is a common law marriage?

A common law marriage is one formed without a license and solemnization by a minister, a priest, a judge of a court of record or by a public official whose powers include solemnization of marriages (mayor, city judge, or justice of the peace).

The State of Montana recognizes both formal marriages which comply with the marriage statutes and common law marriages which do not comply with the marriage statutes, but nonetheless meet the requirements set out in Montana case law. Montana is one of nine states that allow common law marriages.

What establishes a common law marriage in Montana?

The Montana Supreme Court has established three elements for creating a common law marriage. The party asserting the existence of a common law marriage must prove the following three elements to the district court.

First, the parties were competent to enter into a marriage. The competency requirements for a common law marriage are the same as those in a traditional marriage. The parties cannot be related. They cannot be already and for them as a family, the three of them were able married to someone else. They must have the mental capacity to enter into a marital relationship.

Second, the parties assumed a marital relationship by mutual consent and agreement. This means the two people expressed their intent to be married and also each expressed this desire to the other. The mutual consent of the parties does not need to be expressed in any particular form and can be implied from the conduct of the parties.

Other ways of expressing mutual consent vary from marriage to marriage. The agreement may occur privately without anyone else present or it could be witnessed by many. However, in Montana two people cannot create an unintended common law marriage.

Third, the parties confirmed their marriage by cohabitation and public repute. Common law marriages validated by the Montana Supreme Court typically have focused on this element. Because the common law marriage elements cannot be established immediately, particularly cohabitation and public repute, the Court does not require the party seeking to establish the common law marriage to prove they all happened immediately or instantly.

While cohabitation is one issue the court will consider, it is not the determining factor. The perception that if a couple lives together for a certain number of years, they automatically have a common law marriage is wrong. There is no specific length of time of living together that creates a common law marriage in Montana.

To determine whether a couple has held themselves out to the public as married, the Montana Supreme Court considers a number of actions including, but not limited to, exchanging rings, taking the partner’s last name, filing joint tax returns, referring to one another as husband and wife or spouses, and filling out documents/forms with a signature line indicating “spouse.”

Having different last names is not proof positive one way or the other of the existence of a common law marriage. Maintaining separate financial accounts or having joint accounts may not matter. Holding themselves out as married to the public, friends, and family would be an indicator of marriage.

The best case for common law marriage would be a combination of all these factors. However in some court cases only one or two of the factors existed for the marriage to be considered common law. The clearer the proof, for example all the neighbors said they thought the couple were married, or both wore wedding rings, or they had the same last name, the more likely the district court will rule the marriage as common law.

Two competent individuals could live together their whole adult lives and never form a common law marriage. If they never represented themselves to the community at large as spouses; if they never acted as if they were a married couple rather than a pair living together; and if they never said “we are married;” then a common law marriage does not exist. District courts and ultimately the Montana Supreme Court consider all the facts presented in each case.

What documentation could provide proof of a Montana common law marriage while both parties are living?

A couple wanting to demonstrate a marital relationship by mutual consent and agreement (the second element of a common law marriage) could complete the Affidavit of Common Law Marriage form from the Montana State Law Library (https://courts.mt.gov/forms/marriage). Click on Forms.

The form is signed by the couple and sworn before a notary public for the State of Montana. The form states:

“Your signature on this document may be considered proof of a common law marriage. A common law marriage carries the same rights and responsibilities as a solemnized marriage. If you have any questions about the effects of the document, you should contact an attorney.”

The completed form can be used in situations where proof of marriage is required, such as applying for Social Security benefits. The affidavit could also be used by a surviving spouse of a common law marriage who is applying for appointment as a personal representative for the deceased’s estate.

The Montana Legislature has created another method that can be used to document a common law marriage. A couple may file a Declaration of Marriage without Solemnization with the Clerk of the District Court. The document serves as an official record of the marriage of the two parties and the date the two agreed they were married. The declaration can be typed or handwritten. The information to be included in a Declaration of Marriage is listed in a fact sheet at this site: www.co.yellowstone.mt.gov/clerk_court/DeclarationofMarriageInformationSheet.pdf. In 2019 the cost to file a declaration is $53, the same as a marriage license.

Is a common law marriage recognized on reservations in Montana?

Twelve tribal nations are within the boundaries of Montana. These tribal nations govern seven reservations. Each reservation has a tribal code that either validates or prohibits common law marriages. Individuals should review the most current version of the tribal code on their reservation to determine whether a common law marriage is recognized.

Is a Montana common law marriage legal in other states?

A common law marriage recognized in Montana will be accepted by every state in the nation. Eight other states and the District of Columbia recognize common law marriages formed within their borders: Alabama, Colorado, Iowa, Kansas, Rhode Island, South Carolina, Texas, and Utah. Montana also accepts common law marriages recognized in these states.

How is a common law marriage terminated?

A common law marriage is a real marriage and requires a legal Dissolution of Marriage (commonly referred to as a divorce) to terminate the marriage. The State Law Library provides the appropriate forms for ending a marriage in Montana. An attorney could also be consulted to assure the legal rights of each party are protected (http://courts. mt.gov/forms/end_marriage).

Upon a separation or dissolution of marriage, the rights and duties of the parents of the children are outlined in a Parenting Plan. The State Law Library of Montana provides the appropriate forms for developing a Parenting Plan http://courts.mt.gov/forms/dissolution/kid. The legal advice of an attorney could also be helpful to protect the rights of the children.

Are children of a common law marriage “legitimate?”

Children of a common law marriage are “legitimate” children of the marriage. Even without a formal or common law marriage, Montana law considers all children “legitimate.” Children have the same inheritance rights as outlined in scenarios one through six later on in this MontGuide.

May the spouse in a common law marriage be appointed as personal representative?

Each party in a common law marriage can write a will and nominate the other to carry out his or her plan for the settlement of the estate. In Montana, the individual who performs this function is called a personal representative. The district judge or the clerk of court makes the appointment based on the nomination in the written will. In performing his or her duties, a personal representative must follow procedures set out in the Montana Uniform Probate Code (UPC).

If an individual dies without writing a will, the district judge appoints a personal representative based on a priority order in the Montana UPC. The surviving spouse of a common law marriage has priority over all other relatives to be appointed as personal representative.

What amount does a surviving spouse in a common law marriage inherit?

The surviving spouse of a common law marriage has the same rights of inheritance under the Montana Uniform Probate Code (UPC) as any other surviving beneficiaries. However, the amount passing to a surviving spouse depends upon whether the decedent (person who died) has surviving parents or lineal descendants (children, grandchildren or great grandchildren). Different family situations are described in scenarios one through six. Each scenario assumes the decedent had property titled in his or her name only.

What other factors determine the distribution of the estate in a common law marriage?

The Montana UPC as outlined in scenarios one through six provides for the distribution of a deceased Montanan’s property assuming he/she died without a written will or trust. For further information see the MSU Extension Montguides, Wills (MT198906HR) and Revocable Living Trusts (MT199612HR).

The distribution of the estate also depends upon two additional factors.

1. How the property is titled. In other words, whose name appears on the real property, checking and savings accounts, stocks, bonds, and mutual funds? Is the property solely owned? Is the property titled as joint tenancy with right of survivorship or as tenants in common? For further information see the Montguide, Property Ownership: Estate Planning (MT198907HR).

If the property is held in joint tenants with right of survivorship between the couple, the property passes automatically to the survivor. Proof of common law marriage is not necessary.

2. Presence of a beneficiary designation. In other words, did the deceased owner designate who was to receive the asset upon his/her death with a transfer on death deed on his/her real property, payable on death designation (POD) on bank and credit union accounts, transfer on death registration (TOD) on stocks, bonds, and mutual funds, and/or beneficiary designations on life insurance and retirement accounts? For further information, see the Montguide, Designating Beneficiaries Through Contractual Arrangements (MT199901HR).

Revisit John and Mary’s situation

Let’s examine the situation of John and Mary, the couple mentioned at the beginning of this MontGuide who had lived together for 15 years. When John died he had a $2 million ranch. Let’s see how these additional factors and “what ifs” determine the distribution of John’s estate.

What if John titled the property in his name and he had written a will?

Assume John titled the $2 million ranch in his name only. He wrote a will leaving the ranch to his children. In Montana a person cannot completely disinherit a spouse. If Mary proves a common law marriage, she, as the surviving spouse, could be entitled up to 100 percent. The percentage varies depending upon how long the court determines they were in a common law marriage. For further information see the Montguide, Dying Without a Will in Montana: Who Receives Your Property (MT198908HR).

On the other hand, a person can completely disinherit children. If John had written a will leaving the ranch to Mary, (whether or not she qualified as a common law spouse), she receives the ranch. His children receive nothing. For further information see the Montguide, Property Ownership: Estate Planning (MT198907HR).

What if John titled the ranch in his name and he filed a transfer on deed on the property?

In 2019, Montana legislature authorized transfer on death deeds as a way for people to transfer at death their real property (located in Montana) to one or more designated beneficiaries without probate. For further information, see the Montguide, Transfer on Death Deeds in Montana (MT200707HR).

From 2007 until October 1, 2019 the term beneficiary deeds was used to transfer real property on death. Those deeds are still effective.

- Mary as designated beneficiary: If John had the ranch titled in his name only and later filed a transfer on death deed naming Mary as the designated beneficiary, upon his death the ranch automatically becomes Mary’s. Why? Because the transfer on death deed listed her as the designated beneficiary. His children receive nothing.

- Transfer on Death Deed and a Will: If John wrote a will leaving the ranch to his two children; they would not receive it if Mary is listed as the designated beneficiary on the transfer on death deed. A transfer on death deed overrides John’s will. His children receive nothing. For further information see the Montguide, Transfer on Death Deeds in Montana (MT200707HR).

- John’s children as designated beneficiaries: If John titled the property in his name only and later decided he didn’t want Mary to receive the ranch, he could file a new transfer on death deed naming his children as the designated beneficiaries. In this case, the children receive the ranch automatically after his death. This is true even if John wrote a will leaving the ranch to Mary. The transfer on death deed overrides John’s will.

However, if Mary proves a common law marriage existed, then she could claim she was disinherited by John’s transfer on death deed. Under the Montana UPC, she could claim she was a surviving spouse and receive up to 100 percent of the value of the ranch depending upon the number of years the common law marriage existed.

What if John titled the property in joint tenancy with right of survivorship with Mary?

Under Montana contract law, property titled in joint tenancy with right of survivorship automatically passes to the surviving joint tenant. Assume the $2 million ranch was titled in joint tenancy with right of survivorship between John and Mary. Upon the death of John, the $2 million ranch automatically passes to Mary. John’s children do not inherit anything. For further information see the Montguide, Property Ownership: Estate Planning (MT198907HR).

What if John wrote a will leaving the ranch to his two children after the joint tenancy with right of survivorship title on the ranch with Mary was formed?

Whether John wrote a will or after the joint tenancy doesn’t matter.

The joint tenancy with right of survivorship with Mary overrides John’s written will. Upon John’s death Mary becomes owner of the ranch because she was the surviving joint tenant. John’s children do not inherit.

What if John titled the property in joint tenancy with right of survivorship with his children?

Assume John titled his ranch property in joint tenancy with right of survivorship with his children. If Mary proves a common law marriage existed, then she could claim she was disinherited because of joint tenancy contract. Under the Montana UPC the percentage that a surviving spouse receives depends on the number of years of the marriage. For example, if the common law marriage was established as lasting 15 years the surviving spouse could receive 100 percent of the augmented estate.

1. Under the Montana UPC, if the survivor is a common law spouse and the decedent has no surviving descendants (children, grandchildren, great grandchildren) or surviving parent(s), the surviving spouse receives all the decedent’s estate.

SCENARIO 1a – Common Law Marriage: Melissa and Frank have lived together for seven years. Melissa has property solely in her name valued at $400,000. While she does not have children or living parents, she does have two living brothers and two living sisters. Assume Melissa dies without a will and Frank claims he is a surviving spouse. If a common law marriage is proven, all $400,000 passes to Frank.

Figure for Scenario 1a: Common Law Marriage

Legal Heir: Frank, Common Law Spouse

SCENARIO 1b – No Common Law Marriage: However, if the court rules Melissa and Frank did NOT have a common law marriage, Melissa’s two brothers and two sisters inherit all $400,000. Each sibling receives $100,000.

Figure for Scenario 1b: No Common Law Marriage

Legal Heirs: Melissa’s Brothers and Sisters

2. Under the Montana UPC, if the survivors are a common law spouse and descendants of both the decedent and surviving common law spouse, all of the estate passes to the spouse.

SCENARIO 2a – Common Law Marriage: John and Mary have lived together for 25 years. While they have three children, they are not married. Neither have children from a previous marriage. John has an estate valued at $300,000 titled in his name only.

Assume John dies without a will. In district court Mary asserts a common law marriage. If Mary’s claim is proven, all $300,000 passes to her. The children of John and Mary do not inherit because they are descendants of both John and Mary and neither John nor Mary has any other surviving descendants.

Figure for Scenario 2a: Common Law Marriage

Legal Heirs: Mary, Common Law Spouse; John and Mary’s three children

SCENARIO 2b – No Common Law Marriage: However, if the common law marriage between John and Mary is NOT proven, all property passes equally to John’s children (who are the three from his relationship with Mary). Mary receives nothing.

Figure for Scenario 2b: No Common Law Marriage

Legal heirs: John’s Children

3. Under the Montana UPC, if the survivors are a spouse, (whether common law or formally married) and the decedent’s parents, the estate is divided as follows: the first $300,000 and ¾ of the balance passes to the spouse. The decedent’s parents share the remaining ¼. If the estate is valued at $300,000 or less, the common law spouse receives all. The parents receive nothing.

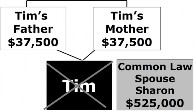

SCENARIO 3a – Common Law Marriage: Tim and Sharon have lived together for 10 years. Tim has property valued at $600,000 titled in his name only. They do not have children. Tim’s parents are living.

Assume Tim dies without a will. If Sharon proves to the district court she is Tim’s common law marriage wife, she receives the first $300,000 and ¾ of the balance for a total of $525,000.* Tim’s parents share the remaining ¼ with $37,500 to each.**

Figure for Scenario 3a: Common Law Marriage

Legal Heirs: Tim’s Parents; Sharon, Common Law Spouse

SCENARIO 3b – No Common Law Marriage: However, if the district court determines a common law marriage did NOT exist between Tim and Sharon, all Tim’s property valued at $600,000 passes to his parents in equal shares ($300,000). Sharon receives nothing.

Figure for Scenario 3b: No Common Law Marriage

Legal Heirs: Tim’s Parents

4. Under the Montana UPC, if the survivors are the spouse (whether common law or formally married), and descendants of both the decedent and surviving spouse; AND if the surviving common law spouse has one or more surviving descendants who are not descendants of the decedent, the common law spouse receives the first $225,000 plus ½ of the balance. The decedent’s children share the remaining ½. Stepchildren do not inherit.

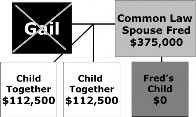

SCENARIO 4a – Common Law Marriage: Gail has an estate valued at $600,000 titled in her name only. Gail and Fred have lived together for eight years and have two children together. Fred also has a daughter from a prior marriage. Assume Gail dies without a will. If Fred proves in district court he is the surviving spouse of a common law marriage, he receives $225,000 and half of the balance for a total of $562,500.* Gail’s children share the remaining portion of the estate, $37,500; $18,750 each.** Fred’s daughter from his previous marriage does not receive any of Gail’s estate.

Figure for Scenario 4a: Common Law Marriage

Legal Heirs: Fred, Common Law Spouse; Fred and Gail’s children

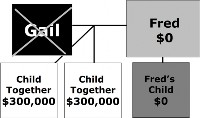

SCENARIO 4b – No Common Law Marriage: However, if the common law marriage is NOT recognized between Gail and Fred, Gail’s two children from her relationship with Fred inherit the entire $600,000. Neither Fred nor his child from a prior marriage inherits anything from Gail’s estate.

Figure for Scenario 4b: No Common Law Marriage

Legal Heirs: Gail’s two children

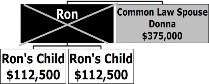

5. Under the Montana UPC, if the survivors are the spouse (whether common law or formally married) and descendants of the decedent who are not descendants of the spouse; the spouse of the common law marriage receives the first $150,000 plus ½ of the balance. The decedent’s children share the remaining ½.

SCENARIO 5a – Common Law Marriage: Ron and Donna have lived together for three years. Ron has two children from a previous marriage. Donna has no children. Ron’s estate is valued at $600,000 and titled in his name only. Assume Ron dies without a will. Donna proves she is surviving spouse of their common law marriage. She receives the first $150,000 and half of the remaining balance for a total of $375,000.* Ron’s two children from a previous marriage split the remaining balance of the estate of $225,000. Each child receives $112,500.**

Figure for Scenario 5a: Common Law Marriage

Legal Heirs: Donna, Common Law Spouse and Ron’s two children from his previous marriage

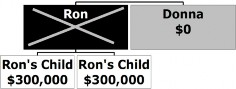

SCENARIO 5b – No Common Law Marriage: However, if the common law marriage between Donna and Ron is NOT recognized, Ron’s two children share $600,000. Each child receives $300,000. Donna receives nothing from Ron’s estate.

Figure for Scenario 5b: No Common Law Marriage

Legal Heirs: Ron’s two children from previous marriage

6. Under the Montana UPC, if the decedent does not have a surviving spouse, descendants or parents, the property passes to his/her brothers and sisters and to their descendants by representation. By representation means the descendants take the share the parent would have received had the parent lived.

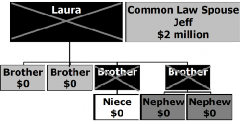

SCENARIO 6a – Common Law Marriage: Jeff and Laura have lived together for 12 years. Laura has a $2 million ranch titled in her name only. She does not have children. She has two living brothers and two nephews and a niece from two brothers who passed away years ago.

Assume Laura dies without a will. Jeff proves he is a surviving spouse of a common law marriage. He receives the $2 million ranch. Laura’s brothers, nephews, and her niece receive nothing.

Figure for Scenario 6a: Common Law Marriage

Legal Heir: Jeff, Common Law Spouse

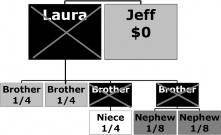

SCENARIO 6b – No Common Law Marriage: However, if the district court rules Jeff and Laura did NOT have a common law marriage, Laura’s two brothers each receive a ¼ interest in the ranch. The other ½ passes by representation to the children of Laura’s deceased brothers. Her niece receives ¼ and her two nephews each receive a ¹/8 interest in the ranch.

Figure for Scenario 6b: No Common Law Marriage

Legal Heirs: Laura’s two living brothers; two nephews and a niece from two brothers who are deceased

The ranch is then owned by five people. The new ownership raises important questions. Who is the decision maker for the ranch? Will each heir want his/her inheritance in dollars? Will one party buy out the other and at what price?

Summary

Couples living together should be aware that a court could later find their actions constitute a marriage. They should be careful not to hold themselves out as married unless they are willing to accept the possible legal ramifications.

Common law marriages have estate planning consequences, not only for the couple, but also for their family members. Children may be concerned about their inheritance rights if one of their parents is “living together” with someone who is not their parent. One of the partners may also wonder if “living together” for a certain number of years proves the existence of a common law marriage.

If an estate planning goal is to protect the inheritance rights of a surviving spouse, then a signed Affidavit of Common Law Marriage form is one method of proving mutual consent and agreement. A Declaration of Marriage without Solemnization also serves as an official record of the marriage of the two parties.

If an estate planning goal is to protect the inheritance rights of children, grandchildren, parents, and siblings, or others, then a will can be written or a trust established. The drafting of a will or trust and the related broader matter of estate planning involves decisions requiring professional skill and judgment, which can be obtained only through years of training, study and experience. An attorney is the appropriate professional to consult about legal documents such as wills, trusts, or contracts that are best suited for your individual situation.

By waiting until after death to take action, the survivor must prove to the district court the existence of a common law marriage based on three elements. First, the parties were competent to enter into a marriage. Second, the parties assumed a marital relationship by mutual consent and agreement. Third, the parties confirmed their marriage by cohabitation and public repute. Proof may vary from case to case depending on the statements of the witnesses and what exhibits are presented to the district court. A wiser course of action for cohabiting couples is to obtain legal advice while both are alive to clarify their legal status.

Acknowledgments

This MontGuide has been reviewed by members of the following:

- State Bar of Montana

- Business, Estates, Trusts, Tax and Real Property Section - Family Law Section

- University of Montana School of Law

References

Common Law Marriage is recognized in the State of Montana, Montana Supreme Court. http://courts.mt.gov/forms/marriage

Common Law Marriage, National Conference of State Legislatures. www.ncsl.org/research/human-services/common-law-marriage.aspx

Montana Codes Annotated 2013, § 40-1-404; §45-2101; §26-1-602

Montana Indian Law. www.indianlaw.mt.gov