Montana Medical Care Savings Accounts (MSAs) for the 2022–2023 Tax Years

A Medical Care Savings Account (MSA) can provide a reduction in Montana state income tax. This MontGuide explains who is eligible, what expenses are allowed, and how to set up an MSA.

Last Updated: 07/22by Marsha A. Goetting, Ph.D., CFP®, CFCS, Professor and Extension Family Economics Specialist, Montana State University-Bozeman; Keri D. Hayes, MSU Extension Economics Publications Assistant

THE MONTANA MEDICAL CARE SAVINGS ACCOUNT ACT

allows Montanans to save money for medical expenses and long-term health care while reducing their state income taxes.

While the term “medical care savings account” implies a savings account, a checking account or certificate of deposit is also permitted. Stocks, bonds, and mutual funds are also allowed investments for an MSA. Individuals should consider how liquid the account will be at the time they expect to need the money for eligible medical expenses.

An MSA must be separate from other accounts and only the account holder can have access to the funds. Joint accounts for MSAs are not allowable. In other words, spouses must establish separate MSAs.

The money deposited in an MSA is not subject to Montana income taxation while in the account or if used for eligible medical expenses for the account holder or anyone else he or she chooses. An account holder has until January 15 to make a withdrawal for an expense paid in the prior tax year.

If an account holder does not use money placed in his or her MSA during the year deposited, it remains in the account and earns interest and dividends free from Montana income taxation, as long as the funds are used for eligible medical expenses in future years. Money used in the reduction of income in one year cannot be deducted from income in a future year.

Who is eligible for an MSA?

All resident taxpayers age 18 and older are eligible to establish a Montana MSA even if they have another health care plan provided by their employer or a Section 125 (Flexible Spending Account) or a Federal Health Savings Account (HSA). A taxpayer does not have to be in a “high deductible” health insurance plan to be eligible for an MSA. An MSA cannot be established for a minor child under age 18. However, parents’ MSAs can be used for eligible expenses for a minor child, as well as children over the age of 18.

Who is eligible to use funds from my MSA?

Formerly, funds in an MSA could only be used by an account holder for his or her parents, spouse or children. The 2017 Montana Legislature passed a law that changed those rules. As of January 1, 2018, money in an MSA can be used to pay eligible medical care expenses not only for the account holder, but also for anyone he or she chooses.

What is the limit on a contribution to an MSA?

The maximum amount used to reduce Montana taxable income was limited to $3,000 annually from 1997 to 2017 for each taxpayer. The amount increased to $3,500 in 2018 and $4,000 annually in 2019. After December 31, 2019, the MSA contribution limit will be increased by the rate of the Consumer Price Index rounded to the nearest $500 increment. The amount in 2022 is $4,500.

A person can also put less than the limit of $4,500 in an MSA. As long as the money is left in the MSA (or withdrawn for eligible medical expenses), it is not subject to state income taxation. The amount that can be used to reduce income for state income tax purposes is the total amount deposited in the MSA during the tax year – not the amount withdrawn for eligible medical expenses. A similar reduction in income, however, is not allowed for federal income tax purposes. Montana has no limitation on the amount of funds and interest that may be accumulated tax-free within an MSA.

Note: All examples within this MontGuide utilize the MSA limit for the 2022 tax year of $4,500.

Example 1: Barbara, a county employee, established an MSA at a local bank and deposited $4,500 in the account on January 31, 2022. During the year, she had $2,500 in eligible medical expenses. On Barbara’s Montana Individual Income Tax Return, her taxable income of $49,000 is reduced by her $4,500 MSA contribution, not the $2,500 she withdrew for eligible medical expenses.

The remaining $2,000 in Barbara’s MSA will continue to earn interest and is available to be withdrawn for eligible medical expenses in future years. However, Barbara cannot use the remaining $2,000 as a reduction of income in a future tax year. Barbara’s Montana adjusted gross income for the present tax year is $45,000 ($49,000 - $4,500 = $44,500). Her Montana income tax will be based on $44,500, less allowable deductions. However, Barbara’s federal income tax will be computed on her federal adjusted gross income of $49,000, less any allowable deductions.

Example 2: Donna and Jim, a married ranching couple, established separate MSAs in 2022. They invested $9,000 in mutual funds ($4,500 in Donna’s and $4,500 in Jim’s).

Their Montana adjusted income of $56,300 is reduced by $9,000 to $47,300 ($56,300 - $9,000 = $47,300). Their Montana income taxes will be computed based on $47,300, less allowable deductions. However, Donna and Jim’s federal income taxes will be computed on their federal adjusted gross income of $56,300, less any allowable deductions.

What if I don’t have $4,500 to deposit in an MSA?

Be creative like this Montanan. “Parlay” a smaller amount into the $4,500 by depositing an amount, taking that amount out, redepositing the amount, and repeat until the total deposits tally to $4,500. It’s the amount that you put in the MSA that provides the tax break.

Example 3: Carly and Bruce cannot afford to place $1,000 in an MSA much less $4,500. However, Carly realized she could put in $200 in an MSA in January. During that month her family had $200 of eligible medical expenses. She took $200 out of her MSA and then immediately redeposited the amount in her MSA. She has now deposited $400. Carly intends to “parlay” her $200 into $4,500 because she has realized through the years her family usually has higher medical expenses that amount to more than $4,500. However, Carly needs to be careful not to withdraw more than she has spent in medical expenses.

Each account holder must maintain documentation of eligible expenses for a minimum of three years from the date the account holder filed a Montana income tax return for the year the expenses were incurred.

How much will I save on Montana income taxes by depositing funds in an MSA?

A Montana taxpayer’s adjusted gross income is reduced by the amount annually deposited to the MSA. The maximum amount can be up to $4,500 for single filers and up to $9,000 total for married couples (2022). As a result of a reduction in income, there is a reduction in the Montana income tax due. The amount of reduction in Montana income taxes depends on the account holder’s tax rate. For information about Montana tax rates, go to https://mtrevenue.gov/taxes/individual-income-tax/individual-tax-rates/.

To determine approximately how much your Montana income tax would be reduced, multiply the amount deposited in your MSA by the tax rate for your taxable income. For example, in 2022 Montanans who had adjusted gross income of $19,800 and above had a 6.75 percent tax rate.

Example 4: Single Person: Nina, a high school teacher, reduced her Montana taxable income of $44,500 by the $4,500 she deposited to her MSA at a local credit union during 2022. Assume Nina has a 6.75 percent Montana income tax rate. Her deposit could reduce the amount of her 2022 Montana income tax due by approximately $304 ($4,500 x .0675 = $304). To be eligible for the maximum state income reduction for the 2023 tax year, Nina must deposit up to $4,500 between January 1 and December 31, 2023.

Example 5: Married Couple: Rob and Sheila, owners of a downtown business, deposited $4,500 each in an MSA with a mutual fund in March 2022. The deposits lower their Montana taxable income by $9,000. They have a 6.75 percent Montana state income tax rate. Their MSA deposits saved them approximately $608 in Montana income taxes ($9,000 x .0675 = $608).

Eligible medical expenses paid with MSA funds cannot be deducted elsewhere on the Montana income tax return.

A person’s medical expenses not covered by health insurance cannot be deducted on the federal income tax return unless they exceed 7.5 percent of federal adjusted gross income.

Example 6: Ben and Bethany have an adjusted gross income of $55,000. Any medical expenses they could deduct on their federal return in 2022 must be above $4,125 ($55,000 x 0.075 = $4,125). Because their medical expenses not covered by health insurance are $3,100, they are not allowed a deduction on their federal return. However, because Ben and Bethany established Montana MSAs in 2022 with a contribution of $4,500 each, they are able to reduce their Montana taxable income by $9,000 even though their withdrawals for eligible medical expenses totaled $3,100.

How much will I save on federal income taxes with an MSA?

Nothing. The amount deposited to a Montana MSA is not eligible for a reduction in income on the federal tax return. However, if a person has medical expenses that exceed 7.5 percent of federal adjusted gross income in 2022 and the person itemizes using Schedule A, that amount can be used.

Example 7: David has eligible medical expenses of $10,000 during 2022. He used $4,000 of his Montana MSA to pay part of his expenses. On his Montana tax return he will receive a deduction for the amount of unreimbursed medical expenses that are in excess of 7.5 percent of his adjusted gross income of $55,000 ($55,000 x .075 - $4,125). He will receive a deduction for $1,875 ($6,000 - $4,125 = $1,875). David may not deduct the $4,000 of expenses that were paid from his Montana MSA.

On his federal tax return David can claim the amount exceeding 7.5 percent of his federal adjusted gross income in 2022 ($55,000 x .075 = $4,125). He can claim only $1,875 as this the amount exceeding the 7.5 percent of his federal adjusted gross income ($6,000 - $4,125 = $1,875). Given the federal standard deduction is $12,950 for a single person in 2022, David will not be itemizing on his federal return.

How much interest will my MSA earn?

Money in an MSA can earn interest just like money deposited in other savings, checking, and investment accounts at financial institutions. The rate of interest is determined by the financial institution where the MSA is established. The interest earned and the investment gains on an MSA are not subject to Montana income tax if they are left in the account or if they are withdrawn for eligible medical expenses. MSA earnings, however, must be declared on the Federal income tax return.

Which is best... an MSA, FSA or HSA?

An MSA is not like the Federal medical care flexible spending account (FSA) offered by some employers where you either “use it or lose it” or the Health Savings Account (HSA) that is deducted from federal adjusted gross income. The amount placed in a Montana MSA, up to the annual limit, can only be used to reduce your Montana income. The amount placed in a Federal Health Care Savings Account (HSA) can be used to reduce both state and federal income. The eligibility requirements are outlined in detail in the MontGuide ‘Health Savings Accounts’ (MT200704HR) available from your local Extension office.

The amount placed in a flexible spending account (FSA) can also be used to reduce both state and federal income. The challenge is a Montanan typically has to decide a year ahead of time how much to expect in medical expenses during the next year that will not be covered by health insurance. Any amount not used is lost, thus the “use it or lose it” phrase is often attributed to FSAs. However, up to $500 in an FSA can be rolled over to the next year.

Example 8: Becky decided to set aside $200 per month ($2,400 during the year) in her FSA. Unfortunately, she had used up all $2,400 by July because of uncovered physical therapy expenses. From July to December she had another $4,500 in eligible medical expenses. She opened an MSA to cover those expenses and was able to reduce her Montana income by a total of $6,900 ($2,400 for the FSA + $4,500 for the MSA = $6,900 in 2022). However, Becky’s Federal income was only reduced by the $2,400 that was set aside in her FSA.

How do I report my MSA on my Federal and state tax returns?

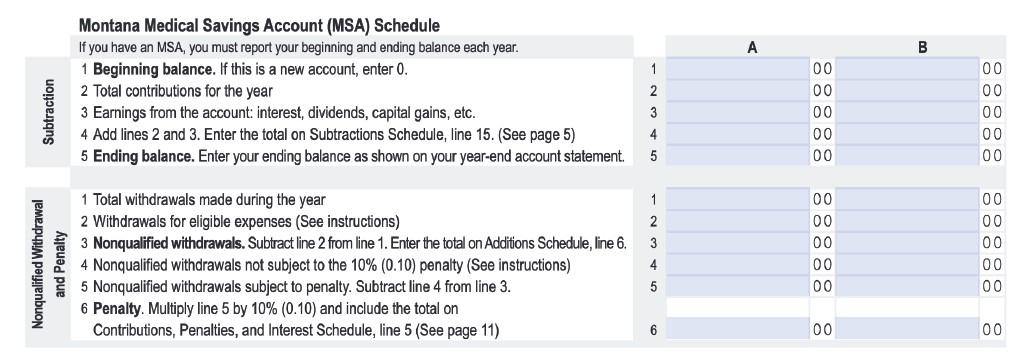

The amount of an MSA deposit is entered as a reduction on the Montana Individual Income Tax Return. For example, on Form 2, page 3 for the year 2021, the amount deposited between January 1 and December 31, 2021, was entered on line 2 (this line number could change from year to year). At the bottom of Form 2, page 3, appears the MSA Schedule. On it, enter the beginning balance on line 1 and the ending balance on line 5.

MSA earnings are reported on the financial institution’s 1099 form that is sent to the account holder and to the Internal Revenue Service (IRS). Some financial institutions send a 1099 form for each MSA. Others may include the MSA interest and investment gains in a total with other interest and investment accounts.

Figure 1: Montana Medical Savings Account (MSA) Schedule (2022)

Closely examine the 1099 to deduct only the appropriate amount on the MSA contribution line on the Montana Individual Income Tax Return.

Remember, ALL MSA interest and investment gains must be declared on your federal income tax return.

What medical expenses are eligible for an MSA?

Money withdrawn from an MSA is not subject to Montana income tax if used for either of these two basic purposes:

1. Paying eligible medical expenses of the account holder or anyone he or she chooses.

The Montana Department of Revenue accepts eligible medical expenses as defined under the Internal Revenue Code Section 213 (d). These are the same expenses that are allowed as itemized deductions for federal income tax purposes such as:

- Medical insurance premiums

- Medicare A premiums: If you are not covered under Social Security (or were not a government employee who paid Medicare tax) and you voluntarily enroll in Medicare A, the premiums paid for Medicare A are eligible medical expenses for a Montana MSA.

- Medicare B premiums

- Medicare D premiums

- Prescription drugs

- Insulin

- Medical and dental

- Nursing care

- Eyeglasses

- Crutches

- Hearing aids

- Transportation for medical care

- Allowable lodging expenses

- Deductible amount and co-payments that are not covered by other types of health insurance

- Premium paid for family leave insurance

- Family leave expenses. A family leave expense is calculated on a monthly basis by multiplying the hourly wage that the caregiver would have been paid by the number of hours that would typically be spent working but were instead spent caring for parents, spouse, or children. The result is divided by 12. The hourly wage for a person paid a salary is the gross annual wage divided by 2,087.

A listing of eligible medical expenses for a Montana MSA is available in IRS Publication 502, “Medical and Dental Expenses.” The publication may be printed from the IRS website at http://www.irs.gov/pub/irs-pdf/p502.pdf.

2. Purchasing long-term care insurance or a long-term care annuity for the long-term care of the MSA holder or anyone chosen.

The Montana Department of Revenue also accepts the purchase of long-term care insurance as an eligible medical expense for the account holder or for anyone else he or she chooses.

The purpose of a long-term care annuity is also an eligible medical expense for the MSA holder or anyone he or she chooses.

What expenses are not eligible for my MSA?

Money held in an MSA may not be used to pay any medical expenses that have already been reimbursed under some other type of insurance coverage.

Example 9: Amy established an MSA at a local credit union and deposited $4,500 in the account on January 10, 2022. During the year, she had medical expenses of $1,400. Her insurance covered 40 percent of medical expenses ($1,400 x 0.40 = $560). The amount not covered by insurance was $840. She decided to use her MSA to pay for the balance of $840 in medical expenses. Amy now has $3,660 left in her MSA to carry over to the next year ($4,000 - $840 = $3,660). On her 2022 Montana tax return Amy reduces her Montana income by $4,500, the total amount she deposited in her MSA.

In 2023, Amy didn’t deposit any money into her MSA, since she felt the $3,660 in the MSA would cover any additional medical expenses not covered by insurance in 2023. Because Amy didn’t deposit any money to her MSA in 2023, she does not receive any deductions on her 2023 Montana income tax return.

Other types of reimbursable items that do not qualify as eligible medical expenses under the Montana MSA law include: medical expenses payable under an automobile insurance policy; workers’ compensation insurance policy; or a self-insured plan; Federal HSA payment; Section 125 (Flexible Spending Account FSA) or medical expenses covered under a health coverage policy, certificate, or contract.

If you are covered under Social Security (or if you are a government employee who paid Medicare taxes), you are enrolled in Medicare A. The payroll tax paid for Medicare A is not an eligible medical expense for a Montana MSA.

Who administers my MSA?

Montana law provides that an MSA can be administered by the individual account holder (self-administered), or a registered account administrator. Regardless of the type of administration selected, the account holder in all circumstances is required to maintain documentation to verify that MSA funds are used exclusively for eligible medical expenses.

Self-Administered Account Holders. Almost all Montana MSAs are self-administered. The MSA may be established with a financial or other approved institution (e.g., banks, savings banks, credit unions, mutual fund companies, etc.)

A self-administered MSA must be kept separate from all other accounts. The account must be maintained specifically for eligible medical expenses for the individual account holder or anyone he or she chooses.

A self-administered account holder must fill out the Montana Medical Care Savings Account Schedule on Form 2 on the Montana Individual Tax Return (available from Department of Revenue) with the Montana income tax return.

Are there fees to establish and maintain an MSA?

Ask the institution if they have any type of maintenance or service fees for MSAs. For example, one financial institution charges a $1 fee per withdrawal for each one in excess of six per month. Another institution may not charge a service fee if the account holder maintains a $300 minimum balance. When the account drops below the $300 minimum, there is a fee of $2 during each month the balance is below the minimum. Maintenance fees are eligible expenses. Some institutions provide free checking for MSAs for depositors age 50 and older.

What types of withdrawals from an MSA can be made without penalty?

The account holder, not the account administrator or financial institution, is responsible for documenting that a withdrawal from an MSA was made for eligible medical expenses.

Withdrawals from an MSA, for any purpose other than eligible medical expenses, are subject to a 10 percent penalty collected by the Department of Revenue on the amount withdrawn unless the withdrawals fall under one of the four exception rules:

1. An MSA holder can withdraw MSA money on the last business day in December, even if the money is not used for eligible medical expenses. However, the amount withdrawn is included as ordinary income for Montana income tax purpose to the extent the funds were excluded on a prior tax return.

Example 10: Thomas, a farmer, established an MSA in March 2021 with $4,000. He did not have any medical expenses during the year so the $4,000 carried over to 2022. On the last business day of the year in 2022, he withdrew $4,000 from his MSA to use for unexpected repairs on his combine. Thus, his Montana adjusted gross income for 2022 increased by $4,000 due to the MSA withdrawal. However, Thomas did not have to pay a 10 percent penalty because the amount was withdrawn on the last business day of the year.

2. A withdrawal upon the death of an account holder is not subject to the 10 percent penalty. The amount withdrawn, however, is added to the decedent’s Montana income for the tax year in which the death occurred, unless the account passed to an eligible beneficiary.

3. The transfer of funds from one MSA to another MSA, such as a different type of investment (from a savings account to a certificate of deposit within the same financial entity) or a different financial institution (from a savings account in a bank to a mutual fund company) is NOT considered a withdrawal and therefore is not subject to the 10 percent penalty.

Example 11: Warren’s MSA funds are in a savings account at his local bank. The MSA has grown to $12,000. He has decided to transfer $9,000 to a certificate of deposit MSA so he can earn a higher rate of interest. He requested that the bank directly transfer the $9,000 to a CD designated as an MSA. He has $3,000 remaining in his savings account MSA. When the CD matures, he can renew it at the prevailing interest rate or he can direct the bank to transfer the balance to his MSA savings account so he can use the funds for eligible medical expenses.

Example 12: Judy has an $8,000 balance in her MSA at a local credit union. She has decided to transfer $2,000 to a local bank. She requested the credit union transfer the $2,000 to the MSA she has established at the local bank.

4. You can reimburse yourself from your MSA for eligible medical expenses you paid, even if the expenses were charged on your credit card. You have until January 15 of the next year to withdraw the funds from your MSA to reimburse yourself for the credit card charge. However, the MSA account must have been already established between January 1 and December 31 of the prior year.

Example 13: Jack took a ski trip between Christmas and New Year’s 2022. During his vacation he fell and broke his ankle. At the emergency room he was asked to pay $200 as payment towards the surgery. Because he didn’t have access to his MSA, which he established in March 2022, Jack paid the bill using his credit card. He has until January 15 of 2023 to make a qualified withdrawal of $200 from his MSA for the expense of the payment he made.

How do I report a penalty?

Self-administered account holders who make withdrawals from an MSA that were not used to pay qualifying medical expenses must report the amount on the MSA schedule available on Form 2, page 4. The money withdrawn is considered ordinary income for Montana income tax purposes. The MSA schedule can be found on the Montana Individual Tax Return at: https://mtrevenue.gov/publications/montana-individual-income-tax-return-form-2/.

What happens to my MSA when I die?

When an account holder dies, Montana law provides a legal procedure for distributing the money in the MSA.

Account Administrator. If the deceased person’s MSA is with an account administrator, he or she is responsible for distributing the principal and accumulated interest in the account to the estate of the account holder or to a designated payable-on-death (POD) beneficiary or transfer on death registration (TOD) beneficiary. This action should be completed within 30 days of the financial entity being furnished proof of the death of the account holder. If there is no POD or TOD, the amount remaining in the MSA is distributed to the estate. The amount then passes to heirs under Montana’s intestacy statutes. (see MontGuide ‘Dying Without a Will in Montana MT198908HR.

Self-Administered Account. The Persona l Representative is responsible for notifying the financial entity of the death of the MSA account holder. The Personal Representative for the estate may (within one year after the death of the account holder) withdraw funds for eligible medical expenses incurred by the deceased.

An account holder can leave the balance in the MSA to anyone or to an immediate family member: parent, spouse, or child through a payable on death designation (POD), by a written will or if no will was written, the MSA is distributed under the intestacy statutes. However, only parents, spouse, or children may receive the balance as an MSA to be added to their MSAs or to establish one.

The transfer must take the form of a direct transfer. A direct transfer can be made using an electronic bank transfer or a check, not cash. If the MSA funds are transferred into funds of a regular account, there is a loss of the tax benefits for the transferred MSA funds.

The transfer to heirs is not included in their gross income. The ending balance of the MSA is reported on Montana Form 2, Schedule MSA, line 5.

Example 14: Don named his wife as a POD beneficiary of his MSA with a balance of $7,000. After his death, his wife may transfer the $7,000 to her MSA without the amount being considered income to her or Don for Montana income taxation purposes.

If a POD or TOD beneficiary is not named, the money in the MSA is distributed according to the account holder’s written will, Montana intestacy statutes (if the person had no written will), or the signed account agreement. The funds from an account of a deceased account holder that are distributed to heirs who are not an immediate family member, are considered nonqualified withdrawals and the amount is recaptured on the income tax return of the estate. There is no penalty to the estate for a nonqualified withdrawal, however.

What happens if I have children who live in Montana and others who live out of state?

If your MSA passes to your children who live in Montana, they get to use it as an MSA. If your MSA passes to a nonresident child, then the amount would be subject to income taxes in the year you died. Your decedent’s income tax return would declare the MSA balance as income. If you had more than $19,800 in income then the tax rate is 6.75% in 2022.

Example 15: Phyllis had an MSA balance of $24,000 when she died. She had placed a POD on the account designating the $24,000 to be divided among her to four children. Only one daughter lives in Montana. Shelia will receive ¼ ($6,000) as an MSA. The remaining $18,000 is subject to Montana income taxes on Phyllis’s final income tax return. Phyllis’s income was $50,000. To that amount is added the $18,000 passing to her out-of-state children. Phyllis’s estate would pay an additional $1,215 Montana income tax for the MSA amount that passes to the three out of state children.

What happens to my MSA if I don’t designate a POD or TOD Beneficiary?

If a POD or TOD beneficiary is not named, the money in the MSA is distributed according to the account holder’s written will or Montana intestacy statutes if the person had no written will.

Example 16: In her will, Gayle named her three daughters as beneficiaries of her MSA with a balance of $9,000. After her death, Gayle’s daughters can transfer $3,000 each to their MSAs without the amount being considered income for Montana taxation purposes either for Gayle’s estate or her three daughters.

Example 17: Rick, a bachelor, died without a will. All his relatives live outside Montana. The personal representative of his estate filed an estate income tax return (Form FID-3) and declared the $20,000 remaining in Rick’s MSA as income for Montana tax purposes.

What happens to my MSA if I become incapacitated?

If an account holder becomes incapacitated, the funds cannot be withdrawn unless a durable power of attorney is given to another individual or unless a conservatorship is granted by the district court to another individual.

A power of attorney is a written document in which a person gives another person legal authority to act on his or her behalf for financial transactions. For additional information request the MSU Extension MontGuide ‘Power of Attorney-Financial’ (MT199001HR) available from your Extension office.

What happens to my MSA if I move from Montana?

If an account holder moves from Montana to another state or country, and has unused MSA funds, those unused funds are considered nonqualified withdrawals and must be declared as income on his or her final Montana Income Tax Return on Form 2, MSA Schedule.

A Montanan with children in Montana could transfer the MSA to their MSA accounts.

MSA Planning Technique

Montana taxpayers who are not sure if they will have eligible medical expenses during the year can wait until the last business day in December to open an MSA.

Example 18: Matt kept documentation of his medical expenses that were not covered by his health insurance policy throughout the year and found they totaled $4,500. On the morning of December 30, 2022, he transferred $4,500 from his regular savings account to establish an MSA. The next day (the last business day of the year), he withdrew $4,000 from the MSA and placed the funds back into his regular savings account. Matt left $500 in the MSA account to keep it active.

Matt can reduce his Montana income by the $4,500 he deposited into his MSA even though the money was in the account for less than 24 hours. On his Montana income tax return he reported $4,500, the amount he deposited, on Form 2, page 5 line 15.

Summary

The Montana Medical Care Savings Account Act allows a Montana taxpayer to establish an MSA and deposit up to $4,500 in 2022. The increase is determined by the Consumer Price Index in $500 increments.

If principal and earnings are withdrawn for payment of eligible medical expenses or for long-term care of the account holder or anyone else, then the amounts are excluded from Montana state income tax. However, only the interest earnings or investment gains are subject to taxation at the federal level.

Withdrawals from an MSA for any purpose other than eligible medical expenses are treated as ordinary income in Montana and taxed accordingly.

Withdrawals are subject to a 10 percent penalty unless the withdrawal falls under the exception rules listed on page 5 and 6.

An MSA can be managed by an account administrator or self-administered by the individual account holder. Most accounts in Montana are self-administered.

Further Information

If you have questions or need additional information about Montana Medical Savings Accounts, contact:

Montana Individual Tax Return: https://mtrevenue.gov/publications/montana-individual-income-tax-return-form-2/

Acknowledgements

This MontGuide has been reviewed by representatives from:

- Montana Independent Bankers Association

- Montana’s Credit Unions

- Montana Department of Revenue

- Montana Society of Certified Public Accountants

Disclaimer

This MontGuide is based on Montana law and Administrative Rules in effect as of date of printing. The information presented is for information purposes only and should not be considered as tax or legal advice or be used as such. For answers to specific questions, readers should confer with appropriate professionals (certified public accountants, attorneys, and certified financial planners).