Developing a Spending Plan

A spending plan helps reduce the need for consumer credit, save for things wanted and live within your income. This MontGuide, with worksheets, will help you balance your income and expenses so that money is available for the things your family needs most.

Last Updated: 07/18by Marsha A. Goetting, Ph.D., CFP®, CFCS, Professor and Extension Family Economics Specialist; Keri D. Hayes, Publications Assistant; and Joel Schumacher, Extension Economics Associate Specialist, Montana State University-Bozeman

IN TODAY’S ECONOMY, MANY CIRCUMSTANCES

can lead to a person’s interest in developing a spending plan. Perhaps you feel your expenses are getting out of control or that you are over-your-head in debt. A sudden drop in income as the result of temporary layoffs, cutbacks or downsizing in your company may necessitate that you track your expenses. The loss of child support, illness, death of a family member, unplanned pregnancy, or divorce may also contribute to a person’s desire to develop a spending plan.

Families who have a spending plan say it is an effective tool to help them get a grip on their money. A spending plan can help families spend hard-earned dollars more effectively, live within their income, reduce the need for consumer credit, save for things wanted and develop skills in financial management.

Decide which family member will take the leadership role in organizing the income and expense records so your spending plan can be developed, reviewed and modified as needed.

STEP 1 – List Income

Begin by listing the income of all earners in the household. On the Monthly Spending Plan Worksheet (page 3), record the take-home figure, or the amount actually available to spend after deductions (base estimates on previous income and current prospects). If income fluctuates sharply, as it may for seasonal workers, commissioned salespersons, farmers/ranchers and other self-employed people, play it safe by making two estimates. Work out the least and most income figures that can be reasonably expected. How long can those incomes be depended upon? Are there other family members who are potential income earners? Possible sources of income include:

- Earnings from employed family members

- Unemployment insurance compensation

- Withdrawals from savings

- Tips or commissions

- Interest or dividends

- Social Security

- Child support or spousal maintenance (alimony)

- Public assistance

- Veterans benefits

- Retirement plan benefits

STEP 2 – Your Monthly Expenses

People frequently ask: What should our spending plan look like? How much should we spend for food, clothing, transportation and so on? Are we spending too much on housing?

Households are rarely alike – thus a “typical’’ spending plan will not apply to everyone. There can be no hard-and-fast rules for family spending, because individual needs, tastes and economic circumstances vary from family to family – even when they have identical income and the same number of family members. However, there are various sources of cost of living information that can be used as guidelines to compare how your family’s spending differs from the average spending pattern of others.

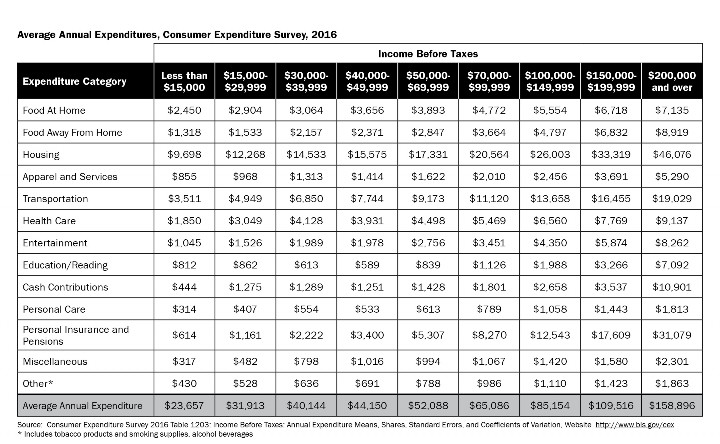

The Consumer Expenditure Survey: The Bureau of Labor Statistics (BLS) regularly collects, analyzes and publishes data on consumer spending patterns (see chart, page 4). The data are annual averages based on the experiences of a large number of consumers. Your family spending will, of course, be different. Compare your annual expenses with the BLS averages listed on page 4 for the year 2016.

For example, assume your income is between $30,000 and $39,999. Find the appropriate annual income column at the top of the chart. The expenses for the expenditure categories are listed under that column. The average family spends $14,533 on housing, $6,850 on transportation, $3,064 on food at home, and so on.

“Rule of Thumb” guide: Examples of financial “Rule of Thumb” guides for various categories of expenditures are listed below:

Housing. Traditionally, the “rule of thumb” for housing expenditures was 30 percent of net monthly income or a maximum home purchase expense of two and a half times annual income. However, these guidelines have become outdated. Today, lenders usually look for the following two income ratios:

- A house payment, including taxes and insurance payments, not exceeding 28 percent of gross income.

- Total obligations for mortgage payment, taxes, insurance, and long-term debt not exceeding 33 to 36 percent of gross monthly income.

Emergency Fund. The amount of an emergency fund needed depends upon many factors, including your family size, income, total assets and lifestyle. There are three guidelines to determine the amount:

- Equal to three months income, or

- Equal to six months of income if you are very conservative or if you have a large family, or

- More than six months of income if self-employed.

Debt. The amount of debt families can safely assume depends on income, living expenses and current debt obligations. Two rules of thumb for limiting consumer debt are:

- Maximum owed on credit purchases should not exceed 20 percent of annual take-home pay (excluding home mortgage payments).

- Maximum debt should not exceed what can be paid with 10 percent of income over 12 to 24 months.

Remember the “Rule of Thumb” guidelines are general and should be used cautiously. They do not take into account unique factors about particular families. For example, larger families may spend higher-than-average amounts for such items as food and clothing; thus leaving less income for housing, transportation and so on.

Categories: If you have tracked your expenses, you know how much is spent monthly for family living expenses. If not, use records, such as canceled checks, bills, and credit card and other receipts to figure out how much you spend. List the amount for each category on the appropriate lines in Step 2 of the worksheet on page 3.

- Housing: mortgage or rent payments, property taxes.

- Utilities: electricity, gas, oil, phone, water, cable TV, Internet, and cellphone.

- Household Operations and Maintenance: repairs, cleaning supplies, paper supplies, equipment, pets and supplies.

- Food: groceries, eating out, school lunches, snacks.

- Transportation: gas, car repairs, maintenance, parking, bus, taxi fares.

- Medical Care: doctor, dentist, clinic, hospital, medicine, glasses.

- Credit Payments: car payments, installment loans, credit cards, charge accounts (If you break out the credit payments into the appropriate family living expense category, you will have a more realistic idea of the actual costs for clothing, entertainment and eating out, for example).

- Insurance: health, life, property, auto, disability, long-term care.

- Clothing and Personal Care: clothing purchases, laundry, dry cleaning, hair care, cosmetics, toiletries.

- Education and Recreation: books, magazines, newspapers, lessons, tuition, hobbies, club dues, sports, entertainment, vacations.

- Miscellaneous: child care, gifts, contributions, personal allowances, child support, alcohol, tobacco.

- Savings: funds set aside for seasonal and occasional expenses, short-term and long-term goals (college fund, retirement).

Remember, not all expenses are monthly. Because some items, such as property taxes or insurance premiums, come due once or twice a year, families often forget about them and do not have the money to pay for them when the bill arrives in the mail. Be sure to include your non-monthly expenses in the spending plan. The MSU Extension Montguide, Schedule of Non-Monthly Family Living Expenses (MT198910HR) can help identify what month these bills are due. The MontGuide also shows how to calculate the amount to set aside in the monthly spending plan to meet these occasional costs. An easy online form that does the calculations for you is at: www.montana.edu/extensionecon/familyeconomics/financialmgtpublications.html.

STEP 3 – Balance Income and Expenses

As you think about what was spent in each of the categories and plan how much to spend now, ask these questions:

- Which expenses are essential to your family’s well-being?

- Which expenses have the highest priority?

- Which areas can be reduced to keep your family’s spending within its income?

- How much can be afforded in each category?

Subtract total monthly expenses from total monthly income. The result is the amount that is “extra” or must be “cut” from expenses. If cuts are necessary, adjust the amounts you plan to spend in each expense category and enter the new amount in the column labeled “Revised Amount” on the spending plan worksheet on page 3.

Add up the revised expenses and compare the total to current income. You may discover you don’t have enough projected income to cover current fixed obligations, or to pay necessary living expenses. If this is the case, some difficult decisions must be made. What can you do if expenses are greater than income?

- Increase income. What are the possibilities for part-time or temporary work to help supplement income. Can other family members seek employment?

- Cut spending. You may be able to cut back on utilities, food, gasoline, clothing, recreation, contributions or gifts. USDA has low cost menus and other resources that help families reduce expenses (www.cnpp.usda.gov/USDAFoodCost- Home.htm).

- Reduce your fixed expenses. If too much income is going to fixed expenses, such as housing or debt payments, there may not be enough money left to cover your other living expenses. This dilemma may make it necessary to refinance loans, move to lower-cost housing, or sell the property to reduce fixed expenses.

- Look at other assets. What savings, investments or property could be used or converted to cash to meet expenses?

What can you do if income is greater than expenses? Allocate the extra dollars to savings for future short-term and long-term goals (education, buying a home, retirement). Use the Montguide, Track’n Your Savings Goals (MT200303HR) to watch your savings grow.

STEP 4 – Review, Track Expenses, and Revise Spending Plan

Once you have developed an initial spending plan that provides for essential family needs and balances expenses with income, review the proposed plan with your family. Spending decisions affect the whole family, so it is important to talk with them and explain that everyone needs to be involved with the process of developing a spending plan.

Family members can decide what their needs and wants are and rank these needs according to importance. Becoming aware of your family’s needs can help you work out the details of a spending plan. If family members understand that tough choices must be made, and if they have a voice in deciding, they will be more willing to accept decisions that require a sacrifice on their part.

Keep a record of what is spent in each expense category to discover if the amount matches what was budgeted for that category. If more was spent in one category than planned, a reduction of spending in another category will be required.

Be sure to involve other family members in tracking expenses. Give each family member a small notebook for daily expenses or use a box or drawer to keep receipts. Label receipts so you know the expense category for each one.

Another method of tracking is a check register. Use the Montguide, Using a Check Register to Track Your Expenses (MT198703HR) for tracking cash, and credit and debit expenses as well as checks.

After tracking expenses for several months you may find your family is operating “in the red.” If so, a couple of things must happen: reduce expenses, increase income, or both. Arrange for a family conference. Lay out the records of income and monthly expenses. Were there differences between your family’s priorities and its actual spending patterns and income? Discuss where cuts can be made with the least sacrifice in family welfare. Examine spending by category. Discuss ideas for either increasing or decreasing the amounts.

If the spending plan did not adequately provide for your family’s needs, it may need to be revised. If the plan suited your family’s needs but members had trouble sticking to it, stricter self-discipline and better management may be required in future months. Enlist better cooperation within your family on spending.

A spending plan is something to keep working and reworking until it suits your family and satisfies individual members. Do not expect to have a perfect spending plan the first time. With each revision, improvement can be expected. Although you may be satisfied with the present plan, it may need to be changed from time to time because of changes in family circumstances, such as a serious illness or accident. As conditions change, reorganize your plan around new goals, needs and wants.

STEP 5 – Managing Your Spending Plan

Although family members may pool their income and make financial decisions jointly, usualy one person assumes the routine responsibilities of money management: paying bills, balancing the checkbook, handling money and keeping records. The individual with more knowledge and skills for this task should be the main money manager. Adult family members may want to alternate the money manager routine periodically. This is an opportunity to appreciate the rewards, and sometimes hassles, of the responsibility.

Set up a money management center to keep all records and supplies in one place. Include these important materials:

- Spending plan and past spending records

- Bills and receipts

- Bank statements

- Credit/Debit card receipts and monthly statements

- Income records such as paycheck stubs, Social Security records and pension receipts

Summary

Getting the most from your income requires careful planning and wise spending decisions. A spending plan based on what your family considers to be most important can help balance spending with available income and resources. Keeping track of spending will help ensure that money is available for the things your family needs most. The step-by-step procedures outlined here will help clarify priorities, make decisions, implement and revise your spending plan.

Other Resources

Many of the following publications are available at no cost online at https://store.msuextension.org or order through your local county Extension office. You many also contact MSU Extension Publications, P.O. Box 172040, Montana State University, Bozeman, MT 59717, (406) 994-3273.

- Check Register Tracking System (EB 50) $1 for Montana residents; $2 for out-of-state residents.

- Helping Friends Cope with Financial Crisis, MT200206HR.

- Lending Money to Family Members, MT199323HR.

- First-Time Home Buyer Savings Accounts, MT199918HR.

- Montana Medical Care Savings Accounts, MT199817HR.

- Premarital Agreement Contracts in Montana: Financial and Legal Aspects, MT201212HR.

- Remarried Families: Making Financial Decisions, MT201211HR.

- Schedule of Non-Monthly Family Living Expenses, MT198910HR.

- Track’n Your Savings Goals, MT200303HR.

- Track’n Your Savings Goals Register, EB 164.

- Using a Check Register to Track Your Expenses, MT198703HR.

- Using a Homestead Declaration to Protect Your Home from Creditors, MT199815HR.

To order additional publications, please contact your county or reservation MSU Extension office, visit our online catalog at https://store.msuextension.org or e-mail orderpubs@montana.edu