Nonprobate Transfers (Contractual Arrangements, Multipleparty Accounts, POD Designations, TOD Registrations)

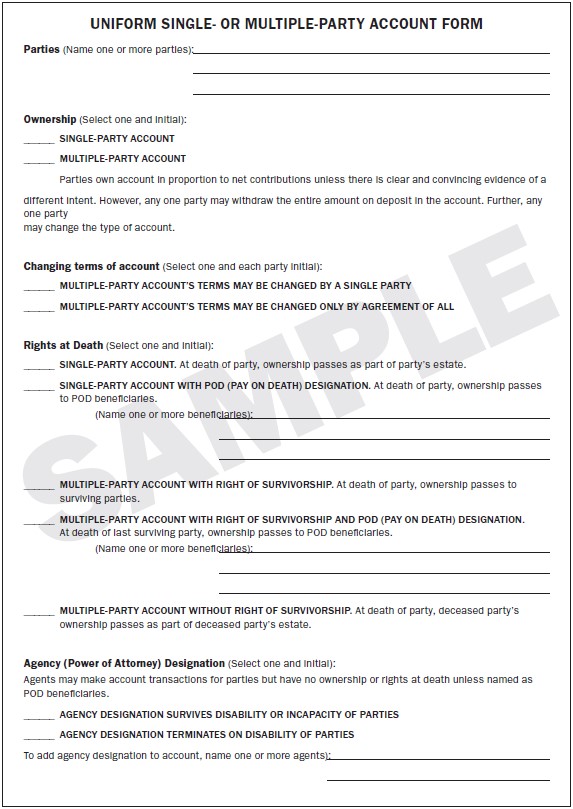

Describes the various forms of property ownership and beneficiary designations that allow the deceased person’s property to bypass probate and transfer directly to beneficiaries. Includes an example uniform single- or multiple-party account form.

Last Updated: 11/22by Marsha Goetting, Ph.D., CFP®, CFCS, Extension Family Economics Specialist and Professor, Montana State University

WHEN AN INDIVIDUAL DIES, MONTANA LAWS PROVIDE FOR

the distribution of their property to appropriate individuals. One factor that determines whether the property goes through probate is how it is titled. Title also affects how property is distributed among the deceased person’s beneficiaries.

Other factors that may influence who receives the property are provisions of the deceased person’s will or if there is no will, the Montana intestacy statutes (see the MSU Extension MontGuide Wills, MT198906HR, or request a copy from your local county Extension office). These statutes include provisions for nonprobate transfers such as multiple-party accounts, pay on death (POD) designations, transfer on death (TOD) registrations, and transfer on death deeds (TODD) (see the MSU Extension MontGuide Transfer on Death Deeds in Montana, MT202010HR, or request a copy from your local county Extension office).

This MontGuide describes some of the common contractual forms of nonprobate transfers of property. It also discusses other nonprobate transfers, such as multiple-person and payable on death (POD) accounts that can be offered by financial institutions (banks, savings banks and credit unions). Finally, the MontGuide explains the transfer on death (TOD) registration that may be used with securities (stocks, bonds, and mutual funds) and securities accounts. Securities with TOD registrations do not go through probate.

Contractual Nonprobate Transfers

There are various contractual arrangements Montana law recognizes as transfers taking effect at death if the specific arrangement provides for the passage of the property to a named beneficiary. Examples of contractual arrangements (see the MontGuide Designating Beneficiaries Through Contractual Arrangements, MT199901HR, or request a copy from your local county Extension office) include but are not limited to: insurance policy, employment contract, custodial agreement, deposit agreement, compensation plan, pension plan, individual retirement account, employee benefit plan, marital property agreement, account agreements with financial institutions and revocable living trusts (see the MontGuide Revocable Living Trusts, MT199612HR, or request a copy from your local county Extension office). What an individual has written in a will about the distribution of assets covered in these contracts does not apply, because the contract takes priority over the will.

Probate is not required for contractual property to be transferred to the beneficiaries. The court-appointed personal representative has no power or duty to administer nonprobate property. In other words, the contractual arrangement determines priority for distribution of the property.

As an example, those designated as beneficiaries in an insurance policy receive the proceeds upon the death of the insured regardless of any provisions in the will distributing those proceeds. The only circumstance when a will determines the distribution of life insurance proceeds is when the estate is named as the beneficiary. The proceeds would then be included as a part of the estate and distributed according to the provisions in the deceased person’s will.

Example: Joe has named his wife as the beneficiary of his $100,000 life insurance policy in his will. Joe later names his son as the beneficiary of the proceeds. Joe’s son will not receive the life insurance proceeds because the contractual agreement has priority. Joe needs to change the beneficiary designation from his wife to his son to achieve his estate planning goal of passing the $100,000 life insurance proceeds to his son. Even if Joe had written a will leaving the $100,000 policy to his wife before he made the beneficiary designation for his son, she would not receive the proceeds.

Definitions

To clarify the Montana multiple-party law, several terms need to be defined. The term multiple-party account is used to include any account having more than one owner with a present interest in the account. A party is one who has a present right to payment (withdrawal, check-writing authority). A party has the usual rights of an owner of the account.

A beneficiary is one to whom account funds are payable after death of all parties. A beneficiary has no present rights associated with ownership of an account. For example, someone who is named a POD beneficiary cannot cash in a certificate of deposit until after the owner is deceased.

Pay on death (POD) designation is the naming of a beneficiary to receive an account balance on a party’s death.

An agent is a person authorized to make account transactions for a party. An agent has no beneficiary rights to money in the account. This means that if the owner of the account dies, the agent does not receive the funds remaining in the account.

Multiple-Party Accounts

Multiple-party accounts can be paid on request to one or more of two or more parties regardless of whether right of survivorship is mentioned. The law also authorizes a payable on death (POD) designation and an agency designation for both single-party and multiple- party accounts. With multiple-party accounts, one party may withdraw the entire amount on in the account. Further, any one party may change the type of account.

However, a POD designation in a multiple-party account without survivorship is ineffective. If there is no right of survivorship, the amount that a party is entitled to immediately before death passes under the account agreement specific to that account and institution if any. Or, if none, the balance becomes part of the deceased person’s estate.

The contributions by the parties is key to their rights in multiple-party accounts. During lifetime, the parties own an account in proportion to their net contributions. The contributions of spouses are presumed equal. If unequal proportions are desired, the account owners should be prepared to prove their contributions by clear and convincing evidence.

The law provides a uniform single- or multiple- party account form that financial institutions may use, although it is not required. The form provides a convenient checklist of features that allow the depositor to choose among the type of accounts. The consequences of various choices are summarized on the form. An example of the account form with the choices provided under Montana law is on page 2.

The deceased person’s net contribution in a multiple-part account with survivorship before death passes according to the account agreement. An account owner wanting the account to flow through their estate can fill out the POD form to make the estate a beneficiary.

The funds in multiple-party accounts may have to be used to pay a deceased person’s creditors if other estate assets are insufficient. The claims that may have to be paid out of the multiple-party account also include the homestead allowance for the surviving spouse ($22,500), family allowances (up to a maximum of $27,000 per year) and exempt property ($15,000).

Multiple-party accounts are not available to the following: partnerships, joint ventures or other business organizations; accounts controlled by an agent or trustee for a corporation, association or charitable or civic organization; fiduciary or trust accounts (for example, custodial accounts under the Uniform Transfers to Minors Act). If no POD beneficiary survives, or if no POD is completed, the account passes under the account agreement specific to the account and institution, if any, or if there is no account agreement, the account passes as part of the last surviving party’s estate. A POD designation cannot be made in a multiple-party account without survivorship.

Payable on Death (POD) Designations

POD beneficiaries or agents have no rights to funds on deposit during the lifetime of the parties. When a party dies, the account belongs to the surviving parties if the right of survivorship option is selected. A POD beneficiary receives funds in the account only upon death of the last surviving party.

If the financial institution has an account agreement, the account agreement governs the distribution of the proceeds if a POD fails or if there is no POD on file. The account agreement supersedes the statutory default. A typical agreement lists a spouse as the beneficiary. If there is no surviving spouse, the children receive the proceeds.. An account owner wanting the account to flow through their estate can fill out the POD form to make the estate as the beneficiary.

Example: John, Susan, Vince and Laura have a multiple- party account that is payable on death to Doug. If John dies, his share is divided equally among Susan, Vince and Laura. Doug would not receive any of the account funds at the death of John. Doug would receive the funds only if all four parties (John, Susan, Vince, and Laura) died. John or any of the other owners (Susan, Vince and Laura) could withdraw all the funds in the account and place in their name only.

Proceedings to claim liability against a POD beneficiary or survivor cannot begin until the personal representative has received a written demand from the creditor, spouse or children. Claims are cut off after one year.

Transfers on Death (TOD) Registration

The Uniform Transfers on Death Security Registration Act allows the owner of securities to register the title in transfer on death (TOD) form. Mutual fund shares and accounts maintained by brokers and others to reflect a customer’s holdings of securities (e.g. mutual fund shares, brokerage accounts, LLC membership interests) are also covered.

The legislation enables an issuer, transfer agent, broker or other such intermediary to transfer the securities directly to the designated transferee on the owner’s death. Thus, TOD registration achieves for securities what the pay on death (POD) designation does for funds deposited at banks and credit unions.

Ownership on Death of Owner of Securities

On the death of a sole owner or the last to die of all multiple owners, ownership of securities registered in beneficiary form passes to the beneficiary or beneficiaries who survive all owners. On proof of the death of all owners and compliance with any applicable requirements of the registering entity, a security registered in TOD or POD form may be re-registered in the name of the beneficiary or beneficiaries who survived the death of all owners.

Until division of the security after the death of all owners, multiple beneficiaries surviving the death of all owners hold their interests as tenants in common. If no beneficiary survives the death of all owners, the security belongs to the estate of the deceased sole owner or the estate of the last to die of all multiple owners.

Montana law does not require a registering entity (broker, firm, transfer agent or other person acting on behalf of the issuer) to offer or accept the TOD registration. However, many investment firms operating in the state provide this option.

Joint Tenancy Title

The transfer on death (TOD) registration, like the POD designation, gives the owner of securities who wishes to arrange for a nonprobate transfer at death an alternative to the joint tenancy form of title. Because joint tenancy registration of securities normally involves a sharing of entitlement and control, such ownership works satisfactorily only as long as the co-owners cooperate. Difficulties can arise when co-owners have disagreements or when one becomes incapacitated, is involved with a marriage dissolution, or becomes insolvent.

If the registration remains unchanged until the beneficiary survives the joint owners, the survivor of the joint owners has full control of the asset and may change the registration form after the other’s death.

The TOD registration has no effect on the registered owner’s full control of the security during their lifetime. However, one party to a joint securities account cannot change the account. Transfers of securities held in more than one name require action by all owners. A TOD designation and any beneficiary interest arising under the designation ends whenever the registered asset is transferred. The designation may end whenever the owner otherwise complies with the issuer’s conditions for changing the title form of the investments.

Tenant in Common Title

Co-owners with right of survivorship, rather than as tenants in common, may be registered as owners together with a TOD beneficiary designation. With the tenancy in common method of ownership, two or more persons hold undivided interests in the same property with no right of survivorship for the surviving tenant in common. “Undivided interest” means each owns a part of the total value. Each tenant in common has the right to transfer their proportional share by selling it, giving it away, or by transferring it to persons of their choice at death by a written will.

A tenancy in common is generally created by the words “to A and B” and nothing more needs to be added. Upon the death of a tenant in common, their interest passes to their heirs by the Montana law of intestate succession or to their beneficiaries by a written will. (For further information about forms of property ownership such as joint tenancy with right of survivorship and tenancy in common see the MontGuide Property Ownership: Estate Planning, MT198907HR, or request a copy from your local county Extension office.)

Example forms of transfer on death (TOD) registration:

- Sole owner, sole beneficiary: Marsha Anderson TOD Budd Anderson

- Sole owner, multiple beneficiaries: Marsha Anderson TOD Sara Anderson and Budd Anderson

- Multiple owners, sole beneficiary: Marsha Anderson and Debbie Anderson JTWROS, TOD Sara Anderson

- Multiple owners, multiple beneficiaries: Marsha Anderson and Debbie Anderson, JTWROS, TOD Sara and Budd Anderson

The letters JTWROS mean joint tenancy with right of survivorship.

Registration with TOD beneficiary has no effect on owners’ rights during lifetime. The TOD beneficiary has no rights until death of the last surviving owner and none if the owner changes the TOD registration. When the owner or owners die, their securities are re-registered in the name of the TOD beneficiary.

Summary

This MontGuide has described some of the nonprobate transfers that are permitted under Montana law. Multiple-person and pay on death (POD) accounts that can be offered by financial institutions (banks and credit unions) were explored. The transfer on death (TOD) registration for securities and securities accounts was highlighted.

References

Montana Code Annotated 2021 §72-6-111, §72-6-112

Acknowledgment

The Business, Estates, Trusts, Tax and Real Property Section of the State Bar of Montana has approved this MontGuide and recommends it for all Montanans.

Disclaimer

This MontGuide is not intended to serve as a complete guide for all non-probate transfers – all details could not possibly be included. Neither is the publication intended to be a substitute for legal advice. Rather, it is designed to help Montanans become better acquainted with some of the devices used in nonprobate transfers and to create an awareness of the need for estate planning. Future changes in state and federal laws cannot be predicted.